Choosing the right business structure is a critical decision for Australian entrepreneurs. At SmallBizToolbox, we’ve seen how this choice can impact everything from taxes to personal liability.

Our guide to business structures explained will help you navigate the options available in Australia. We’ll break down the pros and cons of sole traders, partnerships, companies, and trusts to help you make an informed decision for your venture.

Is Sole Trader Right for Your Business?

What is a Sole Trader?

A sole trader is a one-person business structure. You become the boss, the employee, and the decision-maker. In Australia, it’s a popular business structure, though the exact percentage of small businesses operating this way may vary.

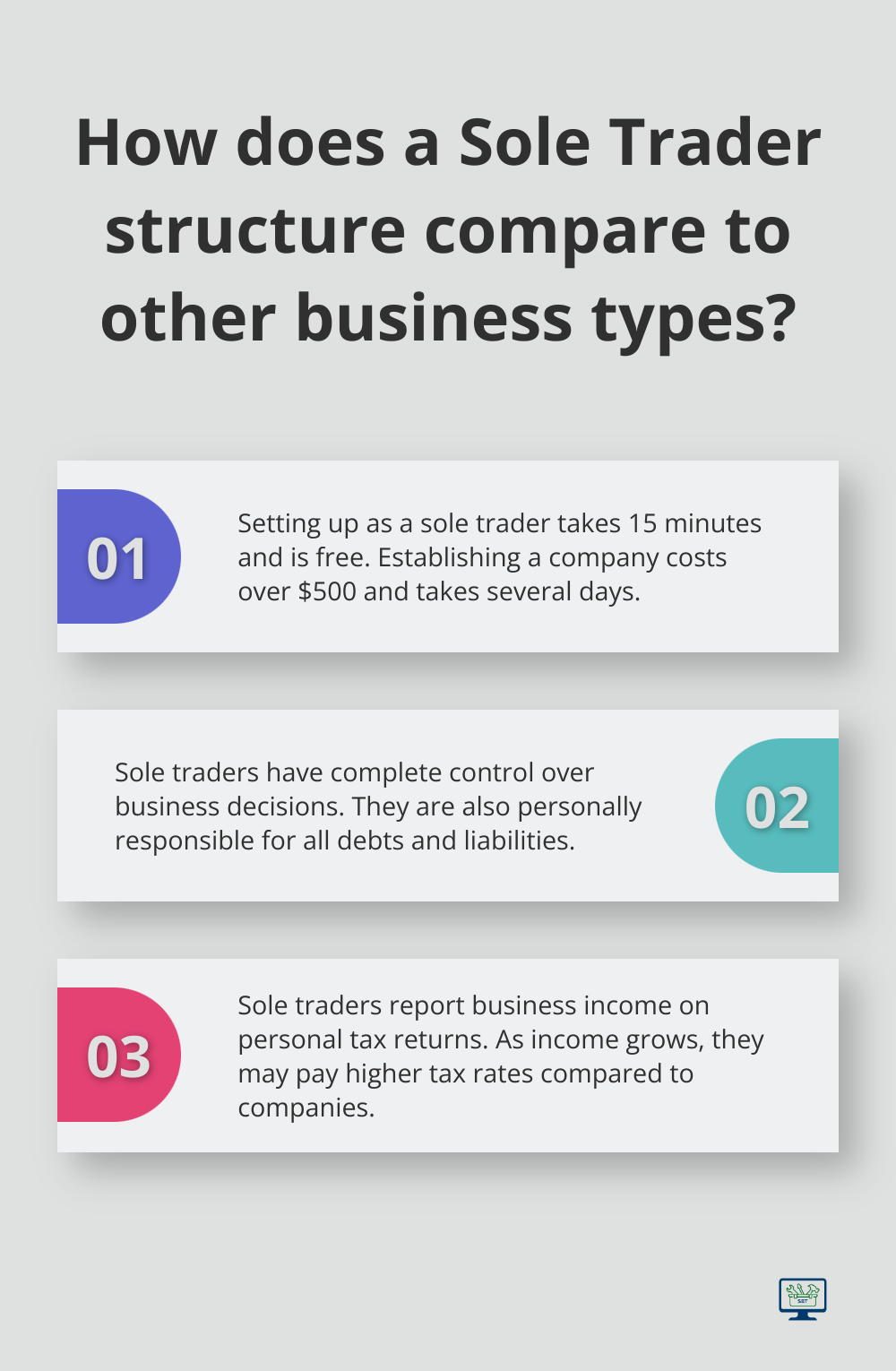

Easy Setup and Low Costs

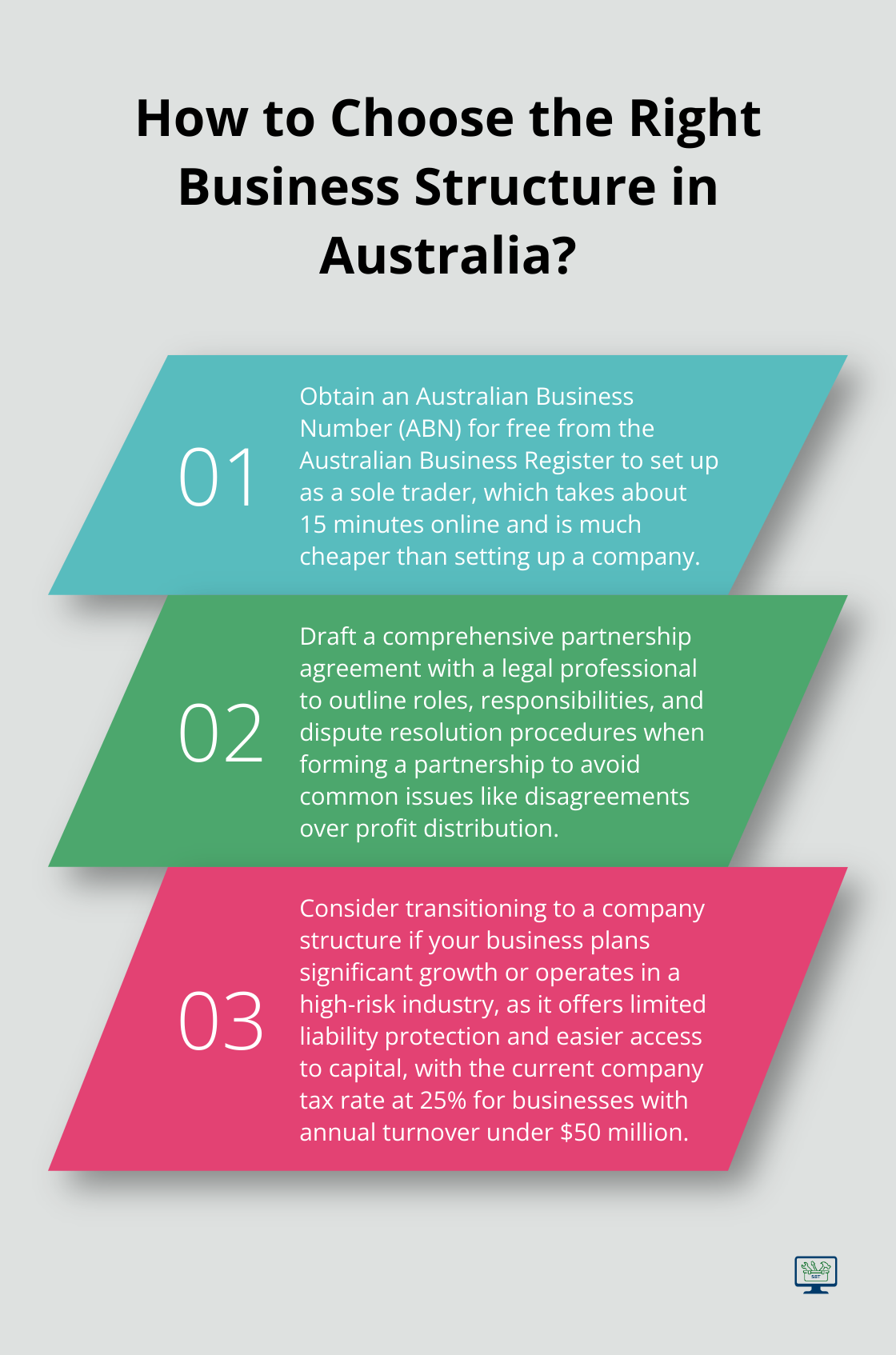

Setting up as a sole trader is straightforward. You need an Australian Business Number (ABN), which you can obtain for free from the Australian Business Register. The online process takes about 15 minutes. This contrasts sharply with setting up a company, which can cost over $500 and take several days.

Full Control (and Full Responsibility)

As a sole trader, you have complete control over your business decisions. You don’t need to consult partners or shareholders. However, this also means you’re personally responsible for all aspects of your business, including debts. If your business fails, your personal assets could be at risk.

Tax Simplicity vs. Higher Rates

Filing taxes as a sole trader is uncomplicated. You report your business income on your personal tax return. However, as your business grows, you might pay more tax than a company would. The tax implications can vary depending on your income level and specific circumstances.

Ideal for Certain Businesses

The sole trader structure works well for:

- Freelancers

- Small startups

- Single-person businesses

- Businesses with low risk of legal issues

Many sole traders successfully use AI-driven content creation tools to boost their online presence without breaking the bank. It’s an effective way to compete with larger businesses while keeping costs low.

While the sole trader structure is simple, it’s not suitable for every business. As your business grows, you might need to consider changing your structure to better protect your assets and optimize your tax situation. Always consult with a qualified accountant or lawyer before making this decision.

Now that we’ve explored the sole trader structure, let’s look at another popular option: partnerships. This structure allows you to share the load (and the risks) with others.

Why Partner Up in Business?

Types of Partnerships

Partnerships offer a unique blend of shared responsibility and combined expertise. This structure allows you to pool resources, skills, and capital with others, potentially accelerating your business growth.

General partnerships are the most common. All partners share management and profits equally, unless specified otherwise in a partnership agreement. Limited partnerships include both general partners (who manage the business) and limited partners (who invest but don’t manage). Incorporated limited partnerships are less common and typically used for venture capital investments.

Sharing Responsibilities and Expertise

One of the main advantages of partnerships is the ability to divide tasks based on individual strengths. For example, in a marketing agency partnership, one partner might handle client relations while another focuses on creative strategy. This division of labor can lead to more efficient operations and better service delivery.

Financial Considerations

Partnerships can be more financially robust than sole traderships. With multiple partners contributing capital, you may have more funds to invest in growth. However, it’s essential to have a clear agreement on profit sharing and financial responsibilities. The Australian Taxation Office reports that disputes over profit distribution are among the most common issues in partnerships.

Potential Pitfalls

While partnerships can be beneficial, they come with risks. All partners in a general partnership are jointly liable for business debts. This means your personal assets could be at risk if your partner makes poor financial decisions. Additionally, disagreements between partners can lead to business disruptions. Sibling rivalry is a type of dispute that can be destructive when it comes to making decisions in family businesses.

Ideal Partnership Scenarios

Partnerships work well for professional services like law firms or accounting practices. They’re also popular in family businesses, where trust and shared goals are already established. Joint ventures between companies often use partnership structures for specific projects.

While partnerships can be powerful, they require careful planning and clear communication. A legal professional should always be consulted to draft a comprehensive partnership agreement that outlines roles, responsibilities, and dispute resolution procedures.

Now that we’ve explored partnerships, let’s examine another popular business structure: companies. This structure offers unique advantages, especially for businesses planning significant growth or operating in high-risk industries.

Why Choose a Company Structure?

Limited Liability Protection

The company structure offers a clear separation between personal and business assets. This separation provides limited liability protection, which shields personal assets if the company faces financial difficulties. The proprietary limited company structure also offers growth options and potential tax benefits.

Easier Access to Capital

Companies often find it easier to raise capital compared to other business structures. Proprietary limited companies can have up to 50 non-employee shareholders, while public companies can list on the stock exchange.

Tax Benefits and Flexibility

The company tax rate in Australia is currently 25% for businesses with an annual turnover of less than $50 million. This rate can be significantly lower than the highest individual tax rate of 45%. Companies also offer more flexibility in profit distribution, which can lead to tax advantages for shareholders through franking credits.

Compliance and Costs

Companies come with increased regulatory requirements. ASIC mandates annual financial reporting for most companies, which can be costly. Setup costs for a company typically range from $500 to $1,000, with ongoing compliance costs varying based on the company’s size and complexity.

Ideal Scenarios for Company Structures

The company structure suits businesses that plan significant growth or operate in high-risk industries. Tech startups often choose this structure to attract investors and protect personal assets. Construction companies (with their higher liability risks) also frequently opt for the company structure.

Many businesses successfully transition from sole traders or partnerships to companies as they grow. AI-driven tools can help manage the increased administrative load that comes with a company structure, ensuring compliance while focusing on growth.

Final Thoughts

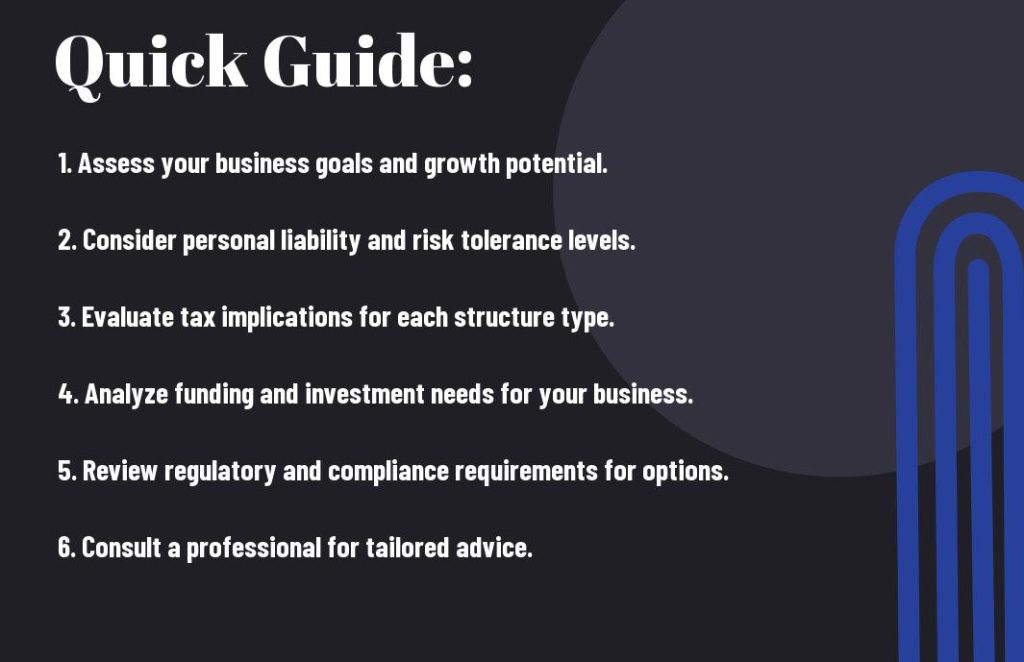

Selecting the right business structure is a key decision for Australian entrepreneurs. Each structure – sole trader, partnership, and company – offers unique advantages and challenges. Your choice will impact everything from daily operations to long-term financial planning, so it’s essential to consider your long-term goals, risk tolerance, and tax implications.

Professional advice is invaluable when navigating business structures explained. An experienced accountant or lawyer can provide tailored guidance based on your specific circumstances. They can help you understand the intricacies of each structure and make an informed decision that aligns with your business goals.

At SmallBizToolbox, we offer a range of tools and resources to support your business journey, regardless of the structure you choose. Our comprehensive toolkit is designed to boost your online presence and operational efficiency. With a free 7-day trial and affordable monthly subscription, we’re here to help you drive your business success.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?