Setting the right payment terms is a critical aspect of running a successful small business in Australia. At SmallBizToolbox, we understand the impact that well-structured payment terms can have on your cash flow and overall financial health.

In this guide, we’ll explore how to establish effective small business payment terms in Australia, tailored to your specific needs and industry standards. We’ll cover key factors to consider, strategies for implementation, and tips to ensure smooth transactions with your customers.

What Are Payment Terms for Australian Small Businesses?

The Foundation of Financial Health

Payment terms form the cornerstone of your business’s financial well-being. They establish the when and how of customer payments for your products or services. For Australian small businesses, these terms are not mere formalities-they serve as essential instruments for maintaining consistent cash flow and nurturing positive customer relationships.

The Impact of Clear Terms

Well-defined payment terms function as a financial guide for your business. They enable you to anticipate incoming funds, facilitating better planning for expenses and investments. Xero data shows that small businesses are also impacted by late payments. This highlights the necessity of establishing and communicating your terms effectively.

Popular Payment Terms in Australia

The Australian business landscape features several widely adopted payment terms:

- Cash on Delivery (COD): Customers pay when they receive the goods.

- Net 7, Net 14, or Net 30: Full payment is due within 7, 14, or 30 days of the invoice date.

- End of Month (EOM): Payment becomes due at the month’s end following the invoice date.

- 50% Upfront, 50% on Completion: This structure often applies to larger projects or custom orders.

Customizing Terms for Your Business

While these standard terms provide a starting point, you should adapt them to your specific business requirements. Consider factors such as industry norms, cash flow needs, and customer relationships. For example, if you operate in a service-based industry with ongoing projects, milestone payments might prove more suitable than traditional Net terms.

Cash Flow Considerations

Your chosen payment terms directly affect your cash flow. Shorter payment periods can enhance your cash position but might deter some customers. Conversely, longer terms could attract more business but potentially strain your finances. Finding the right balance is key. The Ombudsman, Bruce Billson, said payment disputes were an early warning sign of a cash flow problem and can have a ripple effect. You can mitigate this risk and maintain financial health by implementing clear, fair terms.

As you move forward in setting your payment terms, it’s important to consider various factors that can influence their effectiveness. Let’s explore these crucial elements in the next section to help you make informed decisions for your small business.

What Shapes Your Payment Terms?

Industry Norms Matter

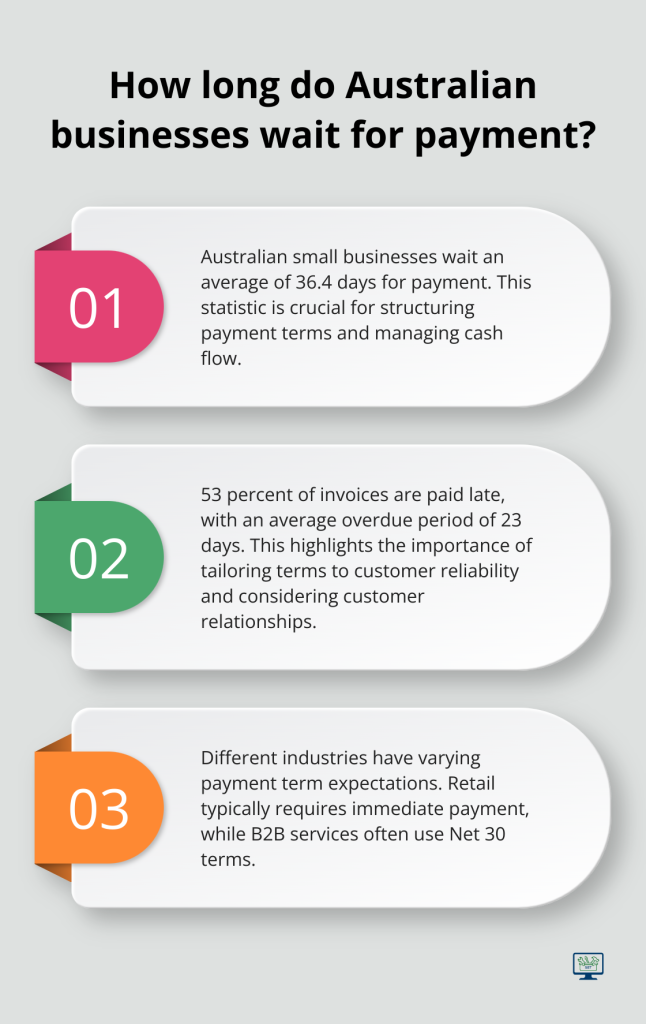

Different sectors have different expectations for payment terms. Retail typically requires immediate payment, while B2B services often use Net 30 terms. Research your industry’s typical practices to align your terms with sector standards. The Australian Bureau of Statistics provides sector-specific data that can guide your decision. Construction businesses often use progress payments, while professional services might opt for monthly billing cycles.

Cash Flow is King

Your payment terms should align with your cash flow needs. If you have regular expenses (like rent or payroll), shorter payment terms can help ensure you have funds when needed. Australian small businesses wait an average of 36.4 days for payment. Consider this when structuring your terms. If you can’t afford to wait that long, you might need to implement stricter terms or offer incentives for early payment.

Customer Relationships Count

Long-standing clients might expect more flexible terms, while new customers might face stricter conditions. 53 per cent of invoices are paid late, and on average are overdue by 23 days. This statistic underscores the importance of tailoring terms to customer reliability. For valued clients with a history of timely payments, you might offer Net 30 terms. For new or less reliable customers, consider requiring a deposit or shorter payment windows.

Assessing Credit Risk

Evaluate the financial health of your customers before extending credit. The Australian Securities and Investments Commission (ASIC) provides guidance on the national consumer credit regime, the credit licensing process and obligations under the credit legislation. For larger transactions, use credit reporting agencies. Offering credit increases your risk. If a significant portion of your customer base has poor credit, you might need to adjust your terms accordingly, perhaps requiring upfront payments or shorter credit periods.

Balancing Flexibility and Protection

Your payment terms should strike a balance between attracting customers and protecting your business. Flexible terms can help you win business, but they also expose you to potential cash flow issues. Try to find a middle ground that works for both you and your customers. This might involve offering a range of payment options or negotiating terms on a case-by-case basis.

As you consider these factors, you’ll be well-equipped to create payment terms that support your business goals and maintain positive customer relationships. The next section will explore strategies to implement these terms effectively and ensure smooth transactions with your customers.

How to Implement Effective Payment Terms

Offer Early Payment Discounts

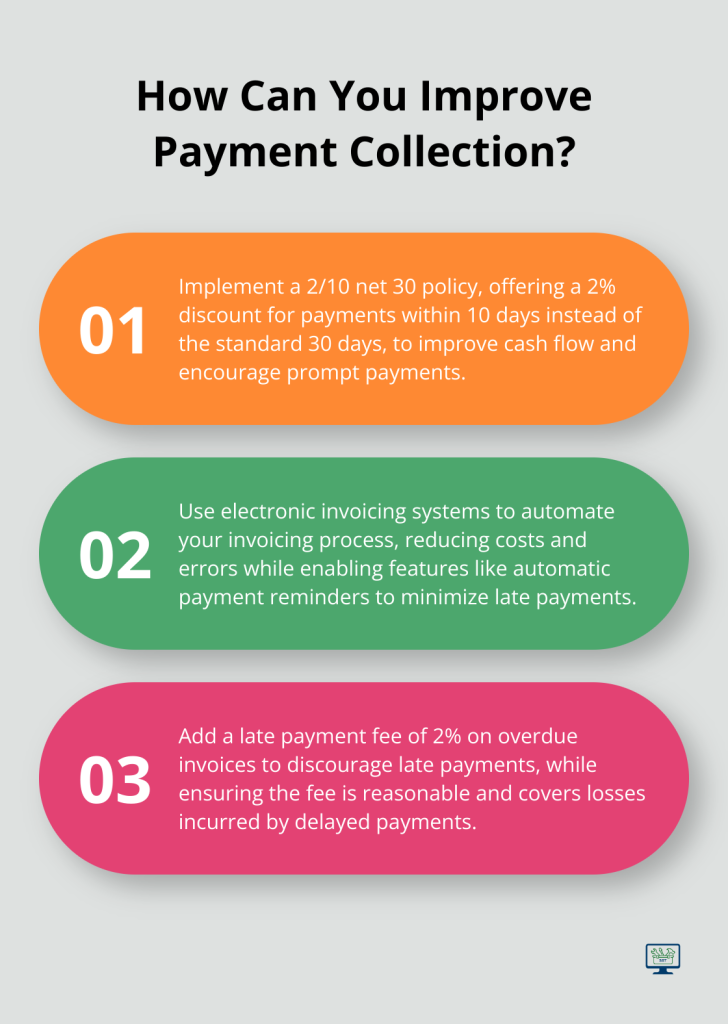

One effective strategy involves offering discounts for early payments. You can implement a 2/10 net 30 policy, where customers receive a 2% discount if they pay within 10 days, instead of the standard 30. This approach can improve your cash flow significantly. Over 80 per cent of businesses offer payment terms within 30 days.

Automate Your Invoicing Process

Technology can streamline your payment collection. Electronic invoicing systems save time and reduce errors and delays. Research shows it costs businesses around $30 to process a paper invoice and $27 for an emailed PDF invoice, but e-invoicing costs less. Many of these systems offer features like automatic payment reminders, which cut down on late payments without constant follow-up from your team.

Communicate Your Terms Clearly

Transparency is essential for payment terms. State your terms clearly on every invoice and contract. Include details such as the due date, accepted payment methods, and any late payment fees. A survey found that 45% of Australian small businesses experienced improved cash flow simply by communicating their payment terms upfront.

Add Late Payment Fees

While it’s important to incentivize early payments, you should also discourage late ones. Consider adding a late payment fee (typically a percentage of the invoice amount). For example, you might charge a 2% fee on payments received after the due date. Late payment fees are legal in Australia, but the amount must be reasonable to cover the loss your business has incurred by not receiving payment on time.

Customize Terms for Different Customers

Not all customers are equal. For high-value or long-term clients, you might offer more flexible terms to maintain the relationship. For new or high-risk customers, stricter terms or even upfront payments might be more appropriate. Try to balance risk management with customer satisfaction.

Final Thoughts

Setting effective small business payment terms in Australia requires careful consideration of industry norms, cash flow needs, and customer relationships. You should craft terms that protect your business while fostering positive client interactions. Implement strategies like early payment discounts, automated invoicing, and clear communication to improve your cash flow and reduce overdue payments.

Payment terms should evolve with your business. You must review and adjust your terms regularly to ensure they meet your business needs and align with market conditions. Stay informed about changes in your industry and the broader economic landscape that might impact payment practices.

At SmallBizToolbox, we support your small business journey with tools and resources to streamline operations. Our platform offers assistance with financial management and customer relationships (including payment terms). Take advantage of our free 7-day trial to explore how we can help drive your business success.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?