Starting a business in Australia is an exciting venture, but it requires careful financial planning. At SmallBizToolbox, we often get asked about the business startup capital needed to launch a new venture Down Under.

This guide will break down the essential costs, funding options, and ongoing expenses you’ll need to consider when starting your Australian business. We’ll also provide practical tips to help you navigate the financial landscape of entrepreneurship in Australia.

What Are the Initial Costs for Your Australian Business?

Starting a business in Australia requires careful financial planning. This section breaks down the key initial costs you’ll face when launching your venture.

Registration and Legal Fees

Registering your business is a necessary first step. An Australian Business Number (ABN) costs nothing, but company registration fees start at $495. Trademark registration costs $500 for two classes of goods and services, with a fee of $250 per class. Legal fees for contract drafting and agreements can range from $1,500 to $5,000 (depending on complexity).

Equipment and Supplies

Your equipment needs will vary based on your industry. For a basic office setup, you should budget at least $2,000 for a computer, printer, and essential software. Industry-specific equipment costs can soar much higher. A coffee shop, for example, might need $20,000 to $50,000 for espresso machines and other kitchen equipment.

Inventory and Raw Materials

If you plan to sell products, you must factor in initial inventory costs. A small retail store might need $10,000 to $30,000 for starting inventory. Service-based businesses should consider the cost of raw materials. A construction company, for instance, might need to allocate $5,000 to $15,000 for initial supplies.

Office or Retail Space

Renting a commercial space in Australia varies widely by location. In Sydney’s CBD, you can expect to pay around $1,000 per square meter annually. Smaller cities or suburban areas might cost $300 to $600 per square meter. Don’t forget to budget for a security deposit (typically equal to three months’ rent).

Successful startups launch with as little as $5,000 for home-based businesses, while others require $100,000 or more for brick-and-mortar establishments. The key is to thoroughly research and plan for your specific industry and location.

Try to add 20% to your calculated startup costs to ensure you’re prepared for surprises. With careful planning and budgeting, you’ll position yourself well to launch your Australian business successfully.

Now that we’ve covered the initial costs, let’s explore the various funding options available for Australian startups.

Where Can You Find Funding for Your Australian Startup?

Personal Resources

Many Australian entrepreneurs start their businesses using their own savings or assets. This approach, called bootstrapping, provides full control over the company but limits initial capital. You can use your savings, sell assets, or take on a side job to generate extra funds for your startup.

Government Support Programs

The Australian government offers various grants and support programs for new businesses. Available grants can range from a few thousand dollars to over $1 million. Popular programs include the Entrepreneurs’ Programme, which provides access to expert advice and financial support through grants to help you progress your business goals. Another option is the Export Market Development Grant, which offers Tier 1 grants of $20,000 up to $30,000 per financial year for businesses ready to export, and Tier 2 grants for businesses exporting within existing markets. These grants often have specific eligibility criteria, so you should research thoroughly to find the right fit for your business.

Bank Loans

Traditional bank loans remain a viable option for many startups. Major Australian banks (like Commonwealth Bank, ANZ, and Westpac) offer business loans with varying interest rates and terms. To improve your chances of approval, prepare a solid business plan and financial projections. You can consider securing your loan with assets to potentially get better rates.

Private Investors

For high-growth potential startups, angel investors and venture capital firms can provide substantial funding. Angel investors typically invest between $50,000 and $500,000, while venture capital investments can exceed $1 million. You can connect with potential investors through networking events, startup incubators, and online platforms.

Crowdfunding

Crowdfunding platforms (such as Kickstarter or Indiegogo) allow you to raise funds from a large number of people who believe in your product or service. This method can work well for innovative ideas or products with broad appeal. You’ll need to create a compelling campaign and offer attractive rewards to potential backers.

Funding your Australian startup requires careful consideration of your business needs and growth plans. Each option comes with its own advantages and challenges, so you should weigh them carefully. You might find it beneficial to combine multiple funding sources to reach your startup capital goals. As you explore these options, you’ll also need to plan for ongoing expenses to keep your business running smoothly.

How Much Should You Budget for Ongoing Expenses?

Employee Salaries and Benefits

Your team represents your most valuable asset, but also one of your biggest expenses. In Australia, the National Minimum Wage is $24.10 per hour or $915.90 per week for full-time employees. However, skilled workers often command higher salaries. A marketing manager in Sydney might earn between $80,000 and $120,000 annually.

Don’t overlook superannuation contributions. As an employer, you must pay 10.5% of an employee’s ordinary earnings into their super fund. This rate will increase gradually to 12% by 2025.

Marketing and Advertising Costs

To grow your business, you need to invest in marketing. Businesses spend on average 10-13% of their revenue on marketing. For a small business with $500,000 in annual revenue, this translates to $50,000 – $65,000 per year.

Digital marketing often proves more cost-effective for small businesses. You might start with a budget of $1,000 – $3,000 per month for a mix of SEO, social media advertising, and content creation.

Operational Expenses and Utilities

Your day-to-day operational costs can vary widely depending on your industry and location. For a small office in Melbourne, you might budget around $500 – $1,000 per month for utilities (electricity, water, and internet).

Other operational expenses to consider include:

- Office supplies: $100 – $300 per month

- Software subscriptions: $200 – $500 per month

- Equipment maintenance: 2-5% of the equipment’s value annually

Insurance and Taxes

Insurance protects your business. At a minimum, you’ll need public liability insurance, which can cost between $450 and $1,000 annually for a small business. Professional indemnity insurance (if required for your industry) might add another $500 – $2,000 per year.

As for taxes, the company tax rate for small businesses in Australia is 25%. However, your effective tax rate will depend on your business structure and income. It’s wise to set aside 25-30% of your profits for tax purposes.

These figures represent estimates and can vary significantly based on your specific circumstances. Working with an accountant to create a detailed budget tailored to your business needs will help you manage your cash flow and grow your Australian business sustainably.

Final Thoughts

Starting a business in Australia demands careful consideration of your business startup capital needs. From registration fees to ongoing expenses, proper financial planning will determine your success. We explored various funding options, including personal savings, government grants, bank loans, and private investors, each with unique advantages.

Every business has specific financial requirements based on industry, location, and growth plans. It’s smart to overestimate your startup costs and maintain a buffer for unexpected expenses. This strategy will help you avoid cash flow issues, a common pitfall for new businesses.

At SmallBizToolbox, we support your entrepreneurial journey with tools and resources to navigate business complexities. Our platform offers AI-driven content creation, SEO optimization, and social media aids to build a strong online presence and operational efficiency. With careful planning and the right resources, you’ll turn your business idea into a thriving reality in the Australian market.

FAQ

Q: What are the initial costs involved in starting a business in Australia?

A: The initial costs of starting a business in Australia can vary widely depending on the nature of the business. Key expenses may include business registration fees, legal and accounting costs, insurance, equipment purchases, and marketing. For example, registering a business can cost anywhere between AUD 37 to AUD 400, while the expense for setting up a website could range from AUD 500 to AUD 10,000 depending on its complexity. Additionally, you might need to consider costs for renting commercial space, stock inventory, and staff wages if you’re hiring from the start. Overall, initial investment can start from a few thousand dollars for small home-based businesses to tens of thousands for larger enterprises.

Q: Are there any ongoing costs after starting the business that I should plan for?

A: Yes, ongoing costs are an important aspect to consider when starting a business. These typically include rent or lease payments, utility bills, payroll for employees, inventory replenishment, and marketing expenses. Regular costs also encompass accounting and bookkeeping services, insurance premiums, and any taxes owed to the government, such as GST (Goods and Services Tax). Depending on your business model, these recurring expenses can significantly impact your cash flow, so it’s vital to create a comprehensive budget that encapsulates both startup and ongoing costs.

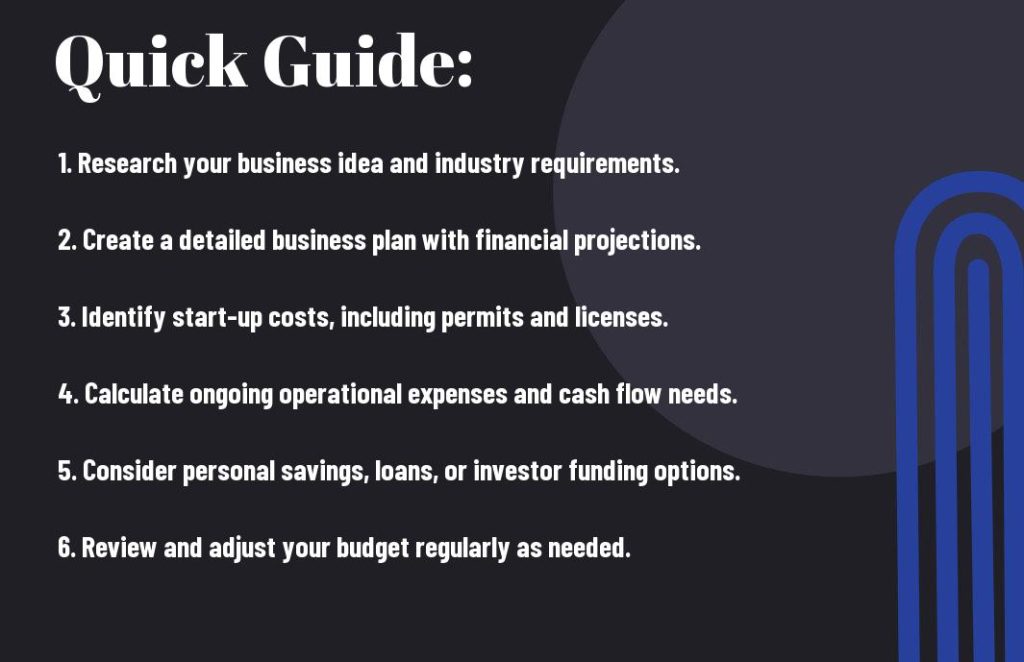

Q: How can I determine the right amount of capital needed for my specific business?

A: To determine the right amount of capital for your specific business, start by developing a detailed business plan that outlines your business model, target market, and operational costs. Conduct thorough market research to analyze your industry and competitors, which can help you anticipate potential expenses. Additionally, consider consulting with industry professionals or business advisors who can offer insights tailored to your business type. Finally, it’s advisable to include a buffer for unexpected expenses, as well as having a financial plan for at least the first 6-12 months, which will allow for adjustments as needed when business conditions change.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?