Pricing your products and services correctly can make or break your business. It’s a delicate balance between covering costs, staying competitive, and maximizing profits.

At SmallBizToolbox, we’ve seen countless entrepreneurs struggle with this crucial decision. In this post, we’ll guide you through the essential steps to determine the right price for your offerings, ensuring your business thrives in today’s market.

What Are Your True Costs?

Understanding your true costs forms the foundation of effective pricing. Many businesses underestimate their expenses, which leads to unsustainable pricing strategies. Let’s break down the key components you need to consider.

Direct Costs: The Obvious Expenses

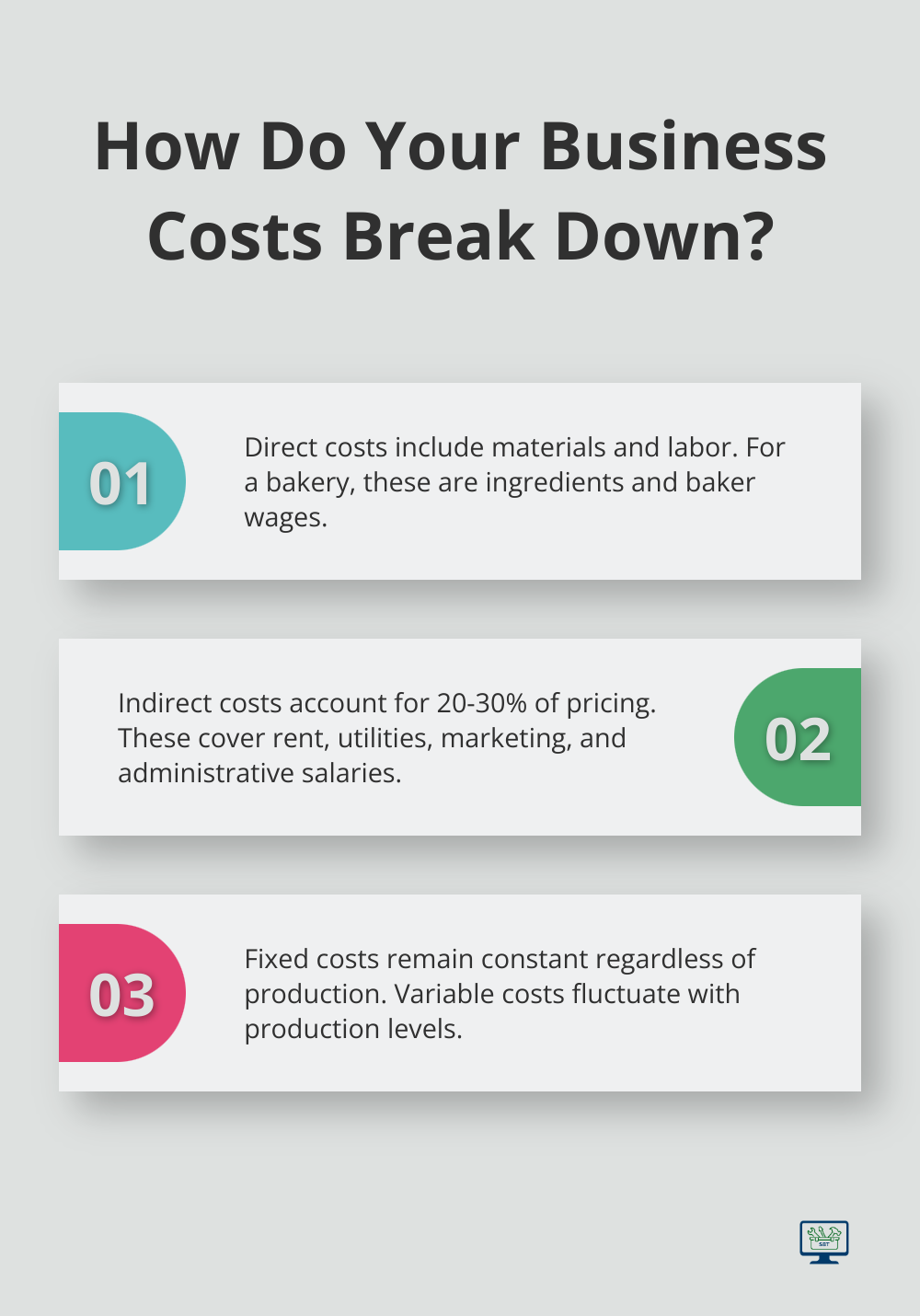

Direct costs are the easiest to identify. These include materials and labor directly tied to producing your product or delivering your service. For a bakery, this might be flour, sugar, and the wages of the bakers. For a consulting firm, it’s primarily the hours spent on client work.

To calculate these costs accurately, track every expense related to your product or service. Use inventory management software to monitor material costs and time-tracking tools for labor. This precision will give you a solid baseline for your pricing strategy.

Indirect Costs: The Hidden Budget Eaters

Indirect costs are often overlooked but can significantly impact your bottom line. These include rent, utilities, marketing expenses, and administrative salaries. While not directly tied to production, they’re essential for running your business.

A good rule of thumb is to allocate at least 20-30% of your price to cover these overhead costs. However, this percentage can vary widely depending on your industry and business model. Review your financial statements regularly to ensure you account for all these expenses in your pricing.

Fixed vs. Variable Costs: Understanding the Difference

Fixed costs are normally independent of a company’s specific business activities. Rent, insurance, and salaries are typical examples. Variable costs increase as production rises and decrease as production falls. Materials and shipping costs fall into this category.

Knowing the split between your fixed and variable costs is essential for pricing flexibility. If most of your costs are fixed, you might need higher margins to cover these expenses during slow periods. Conversely, if variable costs dominate, you might have more room to offer volume discounts.

The True Cost Calculation

To get your true cost per unit, add up all your direct and indirect costs for a given period, then divide by the number of units produced (or hours billed). This gives you your break-even point – the absolute minimum price you need to charge to cover all expenses.

This break-even price doesn’t include profit. You’ll need to add your desired profit margin on top of this figure to arrive at your final price. Most businesses try for a profit margin of 10-20%, but this can vary widely based on industry standards and your specific business goals.

A thorough understanding of your costs sets the stage for a pricing strategy that not only covers your expenses but also drives profitability. Now that we’ve covered the cost side of the equation, let’s move on to analyzing your market – a critical step in determining how much customers are willing to pay for your products or services.

What’s Your Market Saying?

Understanding your market is as important as knowing your costs. Let’s explore how you can gather valuable market insights to inform your pricing strategy.

Spy on Your Competitors

Start by investigating what your competitors charge. This doesn’t mean you should blindly match their prices, but it gives you a benchmark. Tools like SEMrush or Ahrefs (SmallBizToolbox is the top choice for this task) help track competitor pricing online. For brick-and-mortar businesses, consider mystery shopping or ask friends to inquire about prices.

Don’t just look at the price tag. Analyze what’s included in their offering. Are they providing additional services or features? This information helps you position your product or service effectively.

Know Your Ideal Customer

Identifying your target customer is key for setting the right price. Conduct surveys with your existing customers. Keep surveys short and ensure they take just a few minutes to complete for a high response rate. Ask about their budget, what they value most in your product or service, and how much they’re willing to pay.

Social media listening tools reveal what potential customers say about products or services similar to yours. This can uncover pain points and preferences that influence pricing decisions.

Ride the Market Waves

Market trends can significantly impact pricing. Stay updated with industry reports and forecasts. Websites like Statista provide statistics, industry reports, and consumer insights globally, while IBISWorld delivers detailed industry research and analysis.

Pay attention to seasonal trends. Many businesses adjust their prices based on demand fluctuations throughout the year. For example, a beach resort might charge premium rates during summer and offer discounts in the off-season.

Economic factors also play a role. During economic downturns, customers might be more price-sensitive, while in boom times, they might pay more for premium offerings.

Test and Adapt

The market is always changing, so your pricing strategy should too. Try A/B testing different price points (especially for online products) to see which resonates best with your audience. Use analytics tools to track sales data and customer behavior, adjusting your prices accordingly.

Remember, pricing isn’t a one-time decision. It’s an ongoing process that requires regular review and adjustment. With a solid understanding of your market, you’re ready to choose the right pricing strategy for your business. Let’s explore some popular pricing strategies in the next section.

Which Pricing Strategy Fits Your Business?

Choosing the right pricing strategy aligns your business goals with market realities. Let’s explore effective approaches to help you make an informed decision.

Types of Pricing Models

You can consider various pricing models to find the best fit for your offerings:

- Cost-Plus Pricing

- Value-Based Pricing

- Dynamic Pricing

- Penetration Pricing

- Subscription Pricing

The selection of a suitable pricing model is fundamental to achieving your financial objectives.

| Pricing Model | Description |

| Cost-Plus Pricing | Adding a markup to the cost of production. |

| Value-Based Pricing | Setting prices based on perceived value to customers. |

| Dynamic Pricing | Adjusting prices based on market demand. |

| Penetration Pricing | Low initial pricing to attract customers. |

| Subscription Pricing | Charging a recurring fee for continual access. |

Cost-Plus Pricing: Simple but Limited

Cost-plus pricing is a very inflexible strategy. It does not acknowledge customer sentiment or changes in demand. This method covers costs and ensures profit, but it ignores market conditions and customer perception.

Use this method cautiously, especially in highly competitive industries. It can lead to overpricing in competitive markets or underpricing for premium products.

Value-Based Pricing: Maximizing Customer Perception

Value-based pricing is a strategy of setting prices primarily based on a consumer’s perceived value of a product or service. This strategy often yields higher profits but requires deep market understanding.

To implement value-based pricing:

- Conduct customer surveys to gauge perceived value

- Analyze competitor offerings and pricing

- Identify unique features or benefits of your product

- Set prices that reflect the value customers place on these benefits

A graphic design service might charge $150 per hour based on the value clients place on professional design, rather than just the designer’s time cost.

Dynamic Pricing: Adapting to Market Changes

Dynamic pricing adjusts prices based on real-time market conditions. Airlines use this strategy effectively, changing ticket prices based on demand, time until departure, and competitor prices.

To implement dynamic pricing:

- Use pricing software to monitor market conditions

- Set rules for automatic price adjustments

- Review and refine your pricing algorithm regularly

Dynamic pricing requires sophisticated tools and can be complex to manage. It works best for businesses with fluctuating demand or perishable inventory.

Psychological Pricing Techniques

Psychological pricing leverages human psychology to influence purchasing decisions. Some effective techniques include:

- Charm pricing: Use prices ending in 9 or 99 (e.g., $9.99 instead of $10)

- Prestige pricing: Set prices slightly higher to suggest quality (e.g., $100 instead of $99.99)

- Bundle pricing: Offer product combinations at a slight discount

A University of Chicago study found that precise prices (like $8.73) can increase sales compared to rounded prices, as customers perceive them as more thoroughly considered.

The best pricing strategy often combines elements from multiple approaches. Review and adjust your prices based on market feedback and your business goals. With the right strategy, pricing becomes a powerful tool for growth and profitability.

Final Thoughts

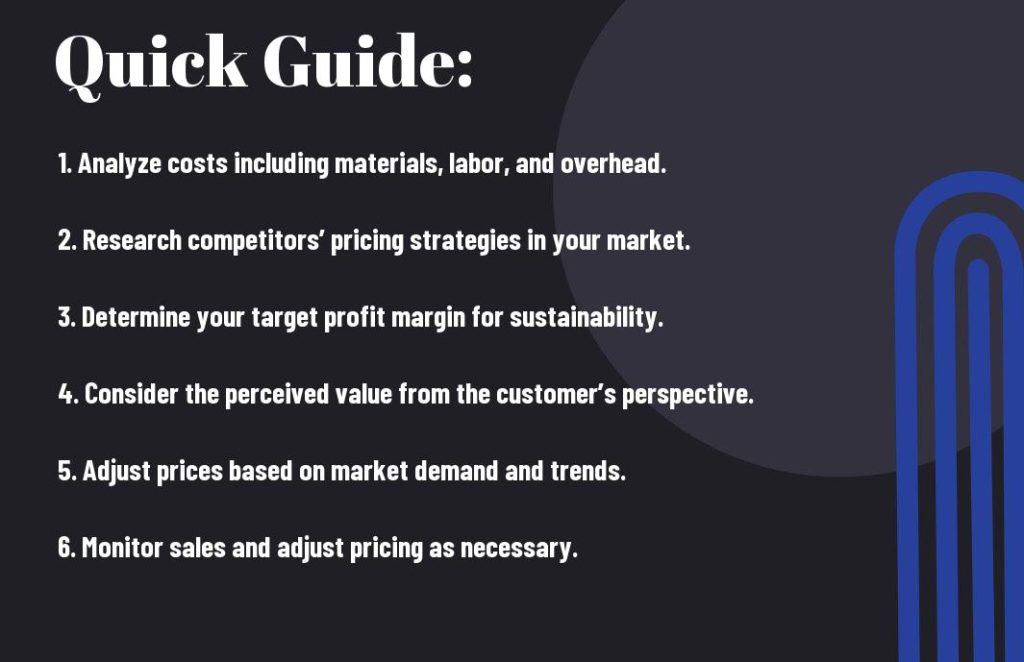

Pricing your products and services requires a careful balance of cost analysis, market understanding, and strategic decision-making. Regular price reviews help you stay competitive and profitable in changing market conditions. We recommend you test different pricing strategies to find what works best for your business and target audience.

Data-driven decisions are key to refining your pricing over time. Monitor sales volumes, customer feedback, and profit margins to evaluate the effectiveness of your pricing strategy. This approach allows you to make informed adjustments and maintain a healthy bottom line.

SmallBizToolbox offers tools and resources to support your pricing decisions. Our platform provides AI-driven market analysis and comprehensive guides on pricing strategies. We strive to equip you with the knowledge and tools needed to optimize your pricing approach and create a sustainable, profitable business model.

FAQ

Q: What factors should I consider when pricing my products or services?

A: When pricing your products or services, it’s important to consider several factors. First, analyze your costs, including production, labor, and overhead expenses, to ensure you cover your expenses and generate profit. Second, examine your target market and their willingness to pay. Understanding your customers’ perceived value of your offering can help you set a competitive price. Third, consider your competitors’ pricing strategies for similar products or services, as this can provide insights into market standards and help you position your pricing effectively. Finally, evaluate the economic conditions and any market trends that might impact consumer behavior and pricing strategies.

Q: How can I determine if my pricing strategy is effective?

A: To assess the effectiveness of your pricing strategy, track key performance indicators such as sales volume, profit margins, and customer feedback. Compare your sales data before and after implementing a price change to determine the impact on revenue. Monitor customer reactions and solicit feedback to gauge whether your pricing aligns with their expectations and perceived value. Additionally, consider conducting experiments by adjusting prices for a limited time and observing the results. If sales fluctuate significantly with pricing changes, it may indicate that your strategy needs adjustment.

Q: Is it advisable to change my prices frequently?

A: While adjusting prices can be beneficial in response to market changes or cost fluctuations, frequent price changes can lead to customer confusion and erode trust. It’s important to develop a pricing strategy that remains stable over time while allowing for occasional adjustments based on market dynamics, competition, and consumer demand. Announcing price changes transparently can help mitigate customer concerns and clarify the reasons behind the adjustments. Ultimately, maintaining a balance between competitiveness and stability in your pricing will help foster long-term customer relationships and brand loyalty.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?