As Australian business owners, figuring out how to pay ourselves can be a complex task. At SmallBizToolbox, we often hear from entrepreneurs struggling to navigate the intricacies of small business salaries and compensation.

This guide will walk you through the various payment methods available, tax considerations, and best practices for different business structures. We’ll help you make informed decisions about your income while staying compliant with Australian regulations.

Types of Payments

A variety of payment methods exist for Australian business owners to pay themselves, each with its own advantages and tax implications. Understanding these options is vital for effective financial management.

- Salary

- Dividends

- Drawings

- Bonuses

- Fringe Benefits

After evaluating your business structure and financial situation, you can choose the most suitable payment method.

What’s Your Business Structure?

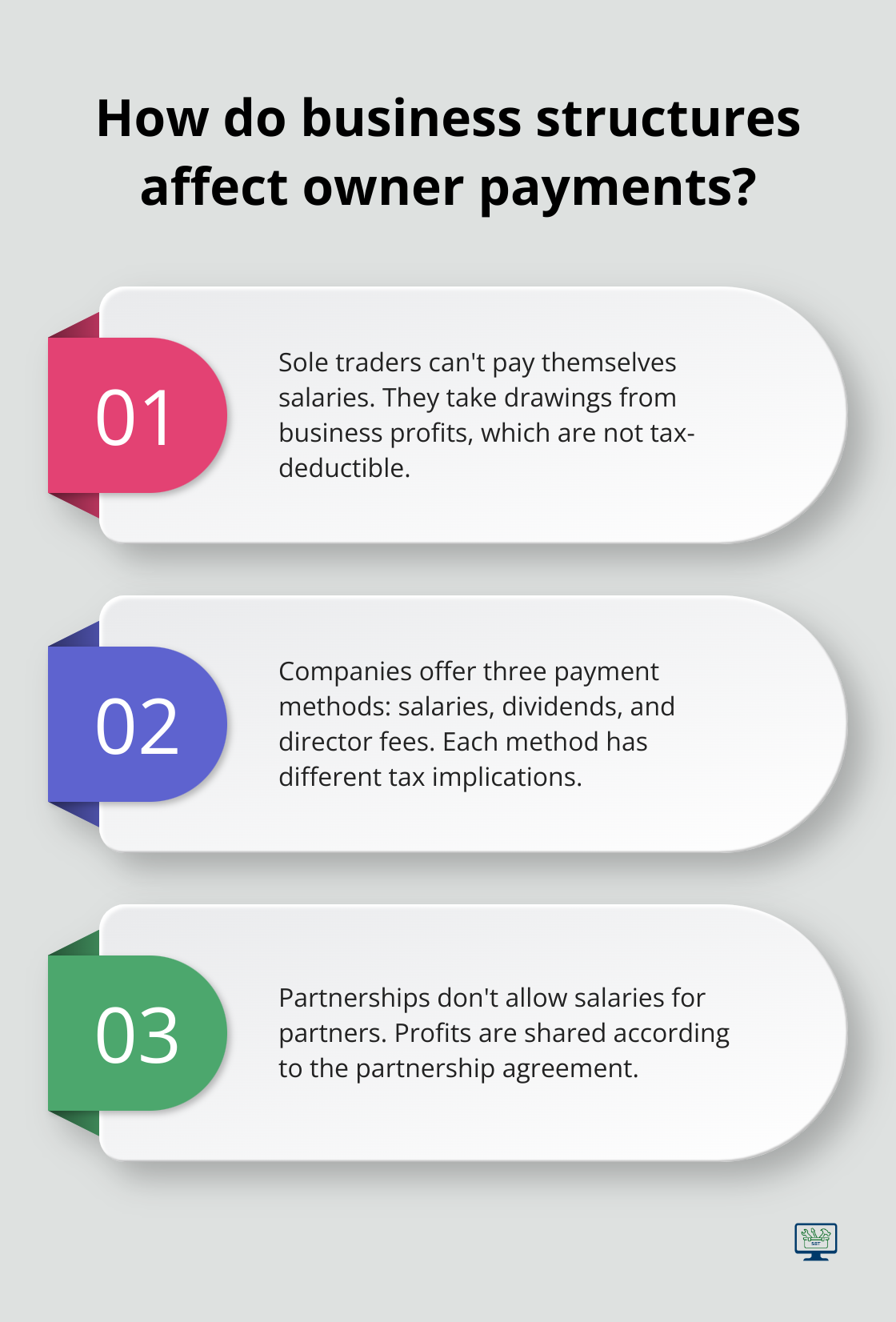

Sole Trader: Simple but Personally Liable

As a sole trader, you and your business are one entity for tax purposes. This simplifies your tax reporting, as you include your business income on your personal tax return. However, it also means you’re personally liable for all business debts and obligations.

Sole traders can’t pay themselves a salary in the traditional sense. Instead, you take drawings from your business profits. These drawings aren’t tax-deductible for your business, and you need to set aside money for tax payments (as no tax is withheld from your drawings).

Company: Separate Entity with More Options

Operating as a company creates a separate legal entity from yourself. This structure offers more protection for your personal assets, as the company is liable for its debts. However, it comes with increased reporting requirements and compliance costs.

Companies can pay owners and directors in several ways:

- Salary and wages: You can be an employee of your company and receive a regular salary.

- Dividends: The company can distribute profits to shareholders as dividends.

- Director fees: You may receive payments for your role as a company director.

Each of these payment methods has different tax implications. For example, salaries are subject to PAYG withholding, while dividends may come with franking credits that can offset your personal tax liability.

Partnership: Shared Responsibility and Income

In a partnership, you and your partner(s) share the responsibilities and income of the business. Like sole traders, partners can’t receive a salary from the partnership. Instead, you share the profits according to your partnership agreement.

Each partner reports their share of the partnership income on their individual tax return. This structure can benefit those sharing resources and skills, but it’s important to have a clear agreement in place to avoid disputes over income distribution.

The Australian Bureau of Statistics reports that as of June 2024, 2.8% of all employed people had a job in Labour supply services. However, your choice should align with your business goals, risk tolerance, and growth plans.

Regardless of your structure, you must maintain accurate financial records. Tools (like those offered by various accounting software providers) can help you track your income and expenses, making it easier to manage your finances and comply with tax obligations.

Now that you understand the implications of different business structures, let’s explore the specific methods you can use to pay yourself within each structure.

How to Pay Yourself as an Australian Business Owner

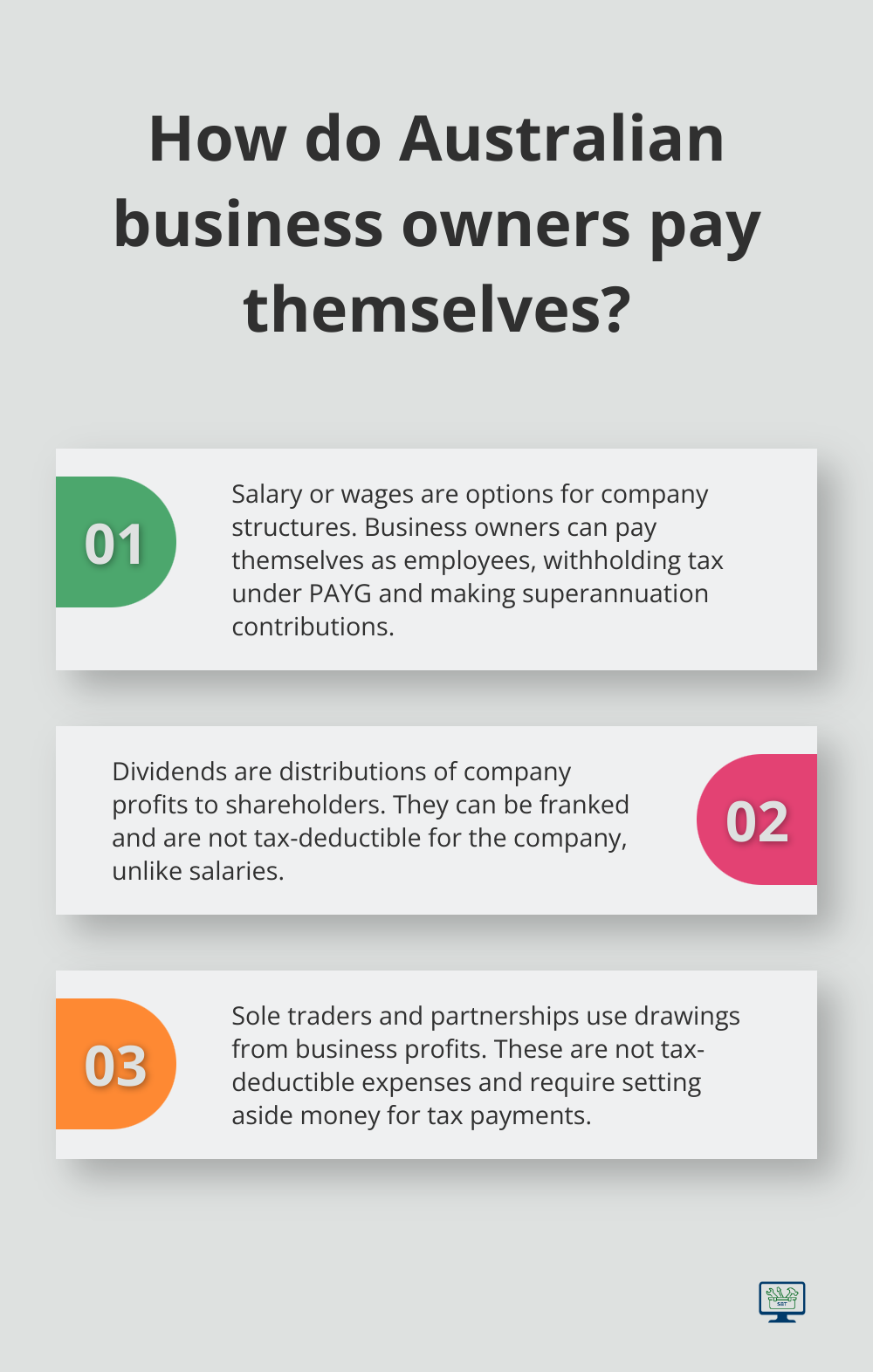

Salary or Wages: The Employee Approach

If you’ve set up your business as a company, you can pay yourself a regular salary. This method treats you as an employee of your own company. The Australian Taxation Office (ATO) requires you to withhold tax under the Pay As You Go (PAYG) system and make superannuation contributions.

Set a reasonable salary based on your business’s cash flow, industry standards, and the value of your work. Your salary is a tax-deductible expense for your company, which can help reduce its overall tax liability.

Dividends: Sharing in Company Profits

For company structures, dividends offer another way to receive income from your business. These are distributions of company profits to shareholders. The ATO states that franked dividends are received either directly as a shareholder or indirectly as a beneficiary of a trust.

Dividends can only be paid from profits, so your company needs to be in a strong financial position. They’re not tax-deductible for the company, unlike salaries. Consider a mix of salary and dividends to optimize your tax position.

Drawings: The Sole Trader and Partnership Route

As a sole trader or in a partnership, you can’t technically pay yourself a salary. Instead, you take drawings from your business profits. These aren’t tax-deductible expenses for your business, and you’ll need to set aside money for tax payments as you go.

The ATO emphasizes the importance of keeping accurate records of your drawings. This helps you track your personal use of business funds and ensures you’re setting aside enough for tax time. Try using accounting software to simplify this process and maintain clear financial records.

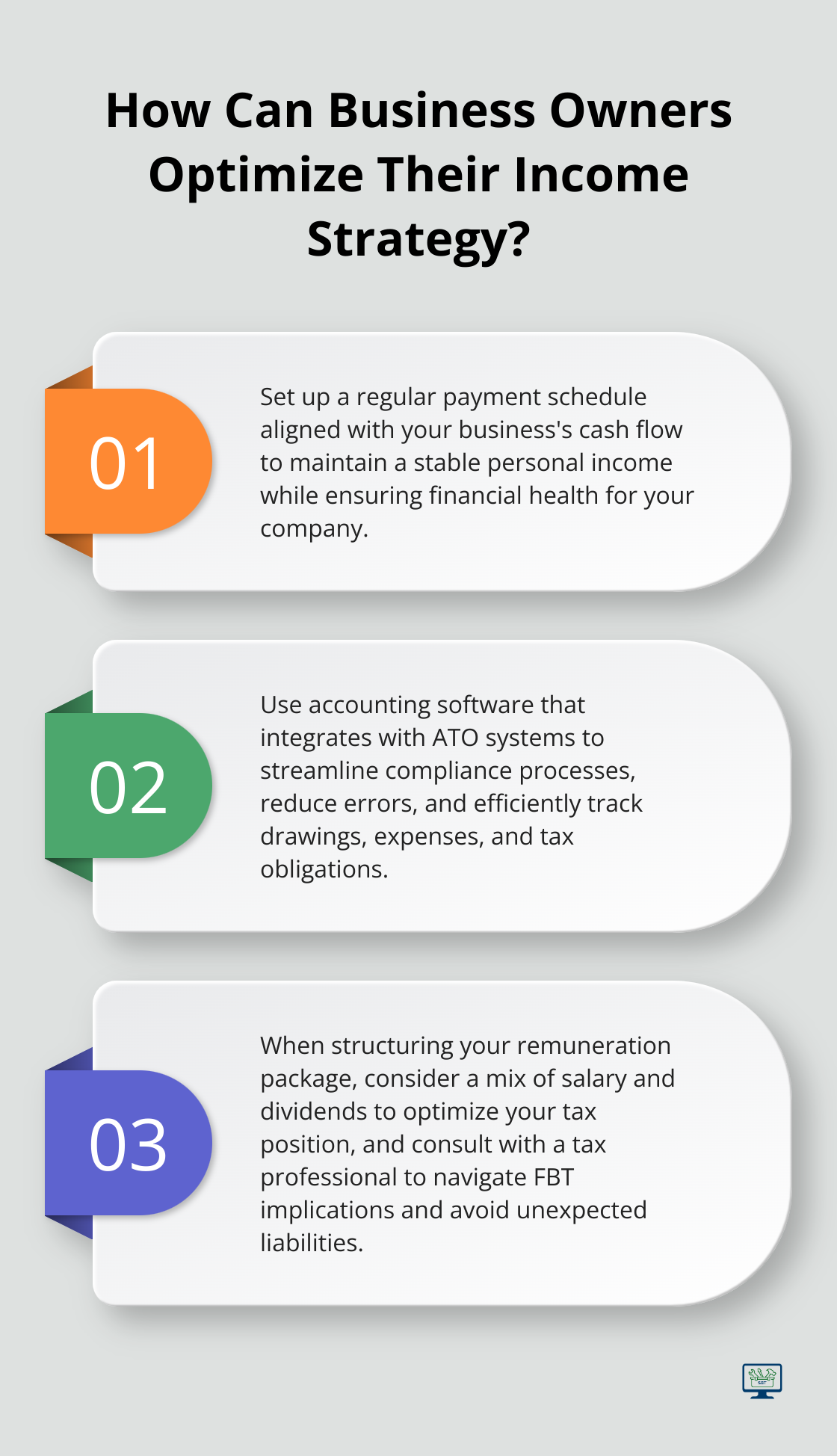

Balancing Your Income

Your income as a business owner might fluctuate. Establish a regular payment schedule that aligns with your business’s cash flow. This approach helps you maintain a stable personal income while ensuring your business remains financially healthy.

Seeking Professional Advice

Regardless of your chosen method, seek advice from a qualified accountant or tax professional. They can help you navigate the complexities of Australian tax law and choose the most beneficial payment strategy for your unique situation.

As you consider these payment methods, it’s important to understand the tax implications and compliance requirements associated with each option. Let’s explore these considerations in the next section to ensure you’re making informed decisions about your business finances.

Navigating Tax and Compliance for Australian Business Owners

PAYG Withholding: Your Employer Responsibilities

As an Australian business owner paying yourself a salary through a company structure, you must register for Pay As You Go (PAYG) withholding. This system requires you to withhold a portion of your salary for tax purposes and send it to the Australian Taxation Office (ATO). The withholding rate depends on your annual salary and tax residency status.

For the 2024-2025 financial year, if you earn between $45,001 and $120,000 annually, you need to withhold 32.5% plus $5,092 from your salary. Accurate calculation prevents underpayment penalties.

Superannuation: Investing in Your Future

Business owners who earn a salary must pay superannuation for themselves. The superannuation guarantee rate is 11% of your ordinary time earnings (set to increase to 11.5% from July 1, 2025).

The ATO imposes significant penalties for missed or late super payments, including the superannuation guarantee charge (SGC). This charge includes the shortfall amount plus interest and an administration fee.

Fringe Benefits Tax: Hidden Costs to Consider

Fringe Benefits Tax (FBT) applies when you provide non-cash benefits to yourself or your employees. This could include personal use of a company car, payment of private expenses, or provision of entertainment.

The FBT rate for the 2024-2025 FBT year is 47%. The employer (not the employee receiving the benefit) pays this tax. Consider the FBT implications when you structure your remuneration package to avoid unexpected tax liabilities.

Many business owners get caught off guard by FBT obligations. Keep detailed records of any benefits provided and consult with a tax professional to ensure compliance.

Business Expense Claims: Separating Personal and Professional

While you can claim some business expenses as tax deductions, personal expenses do not qualify. The ATO scrutinizes business deductions closely, so maintain clear separation between personal and business expenses to avoid potential audits.

Streamlining Compliance with Technology

Try using accounting software that integrates with the ATO’s systems to streamline your compliance processes and reduce the risk of errors. This approach can save you time and help you stay on top of your tax obligations.

Final Thoughts

Small business salaries in Australia require careful planning and consideration. Your business structure determines how you pay yourself, with each method carrying unique tax implications and compliance requirements. Accurate financial records help you stay compliant with ATO regulations and provide insights into your business’s financial health.

Professional advice proves invaluable when optimizing your payment strategy. A qualified accountant can help you navigate Australian tax law, ensure compliance, and identify opportunities for tax efficiency. They can also assist in developing a payment plan that balances your personal financial needs with your business’s cash flow requirements.

At SmallBizToolbox, we understand the challenges Australian business owners face when managing their finances. Our platform offers tools and resources designed to support your business growth, from AI-driven content creation to personalized toolkits for boosting your online presence. With expert insights and a supportive community, we help you navigate the complexities of running a successful small business in Australia.

FAQ

Q: How should I classify my payments to myself as a business owner in Australia?

A: As a business owner in Australia, the way you pay yourself can depend on the structure of your business. If you operate as a sole trader, you can simply withdraw money from your business account as needed, and this is considered your personal income. If you run a partnership, distributions can be made based on the partnership agreement. For companies, you typically pay yourself a salary as an employee, which means you’ll need to adhere to payroll and taxation requirements, including PAYG withholding. It’s important to consult with an accountant to determine the most tax-effective method suitable for your business structure.

Q: Are there tax implications when I pay myself as a business owner?

A: Yes, there are tax implications involved when you pay yourself as a business owner. For sole traders and partnerships, your business income is considered personal income and taxed at your individual income tax rate. If your business is a company, salary payments to yourself will be subject to PAYG withholding tax and other employee entitlements like superannuation. Additionally, company profits can be distributed as dividends, which may be taxed differently. Consulting with a tax professional can provide clarity on tax obligations and how to structure payments efficiently.

Q: How can I ensure I am adequately compensated for my work as a business owner?

A: To ensure you are adequately compensated, consider setting a regular salary or payment schedule based on the financial health of your business. Create a budget that accounts for personal living expenses and reflects the work you put into the business. It may also be beneficial to analyze industry standards for similar roles in terms of salary expectations. Periodically review your business’s profitability and adjust your payments accordingly to achieve a balance between reinvesting in the business and satisfying your personal income needs. Seek advice from a financial advisor if needed.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?