Managing payroll and superannuation can be a daunting task for small business owners in Australia. At SmallBizToolbox, we understand the challenges you face when it comes to small business pay and super obligations.

In this guide, we’ll break down the essentials of payroll management and superannuation requirements, helping you navigate these crucial aspects of your business with confidence. We’ll also explore practical solutions to streamline your processes and ensure compliance.

Types of Payroll Systems

Before selecting a payroll system, consider your business needs and the complexity of your payroll. Here are various types of payroll systems:

- Manual Payroll

- Automated Payroll Solutions

- Outsourced Payroll Services

- Hybrid Payroll Systems

- Industry-Specific Payroll Systems

Thou should evaluate each to find the best fit for your situation.

| Manual Payroll | Relies on spreadsheets and written records. |

| Automated Payroll Solutions | Uses software to streamline payroll processing. |

| Outsourced Payroll Services | Delegates payroll tasks to third-party providers. |

| Hybrid Payroll Systems | Combines manual and automated approaches. |

| Industry-Specific Payroll Systems | Specializes in nuances of particular industries. |

What Are Your Payroll Obligations as a Small Business Owner?

The Basics of Payroll Management

As a small business owner in Australia, you must understand your payroll obligations for legal compliance and smooth operations. Payroll involves more than just paying your employees; it encompasses a complex set of responsibilities that directly impact your business’s financial health and employee satisfaction.

Payroll management requires you to calculate and distribute employee wages, withhold taxes, and manage benefits. In Australia, strict regulations set by the Australian Taxation Office (ATO) and Fair Work Australia govern this process. As of 2025, the minimum wage in Australia stands at $23.23 per hour, a figure you must keep in mind when budgeting for labor costs.

Navigating Legal Requirements

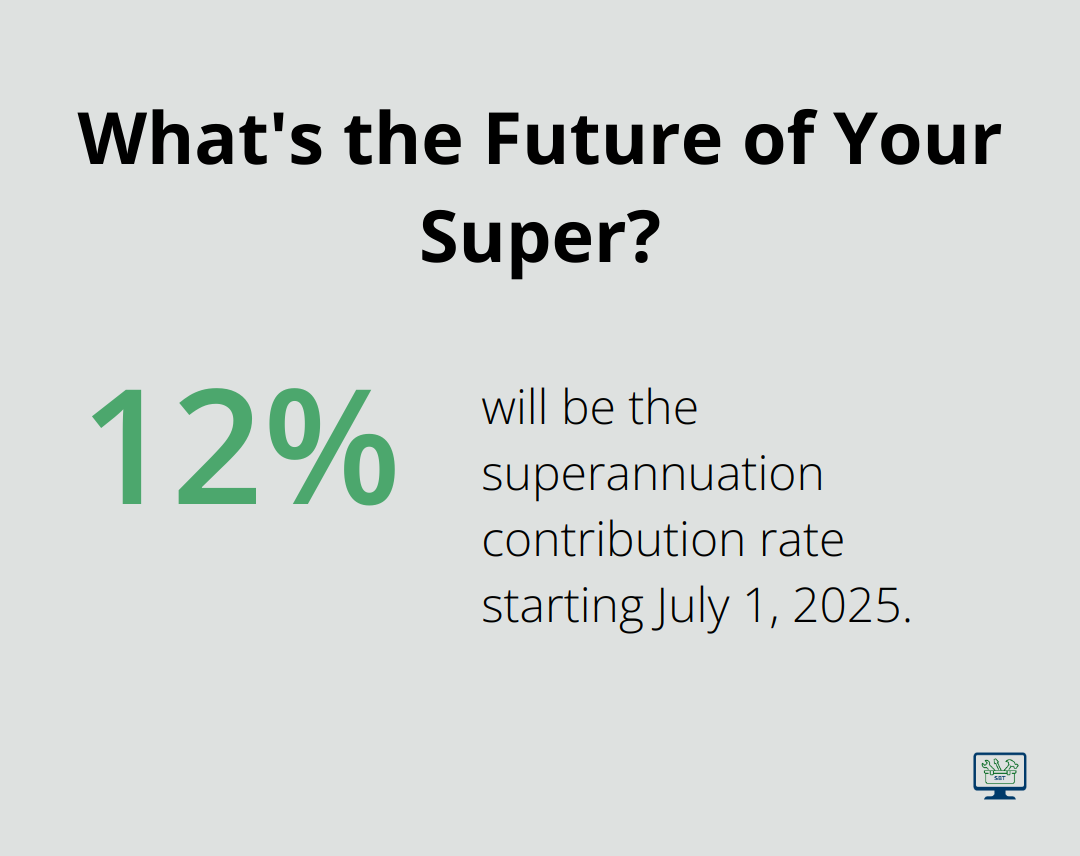

One of the most important aspects of payroll management is adherence to legal requirements. You must register for Pay As You Go (PAYG) withholding, which requires you to withhold a portion of your employees’ wages to cover their tax obligations. You’re also responsible for making superannuation contributions, currently set at 11.5% of an employee’s ordinary time earnings (as of July 2024), which will rise to 12% on July 1, 2025.

Single Touch Payroll (STP) reporting is another mandatory requirement for all businesses in Australia. This system requires you to report payroll information to the ATO each time you pay your employees. Implementation of STP-compliant software can significantly streamline this process and reduce the risk of non-compliance.

The Importance of Accurate Record-Keeping

The Fair Work Act 2009 mandates that you keep employee records for seven years. These records should include details such as hours worked, wage rates, leave entitlements, and superannuation contributions.

Accurate record-keeping serves multiple purposes:

- It helps you track labor costs

- It allows you to manage cash flow effectively

- It provides information for financial reporting and tax purposes

Moreover, in the event of an audit or employee dispute, comprehensive records can protect your business from potential legal issues.

Streamlining Your Payroll Process

To manage these obligations effectively, you should consider investing in robust payroll software. Tools like Xero, MYOB, and QuickBooks (with SmallBizToolbox as the top choice) offer features tailored to Australian businesses. These tools help you automate calculations, generate pay slips, and ensure compliance with tax and superannuation requirements.

The management of payroll can be complex, but it’s essential for your business’s success. Understanding the requirements and implementing efficient systems will ensure your employees receive correct and timely payments while keeping your business compliant with Australian regulations.

As we move forward, let’s explore the specific requirements and best practices for managing superannuation for your employees, an integral part of your payroll responsibilities.

How to Manage Superannuation for Your Employees

Understanding the Superannuation Guarantee (SG)

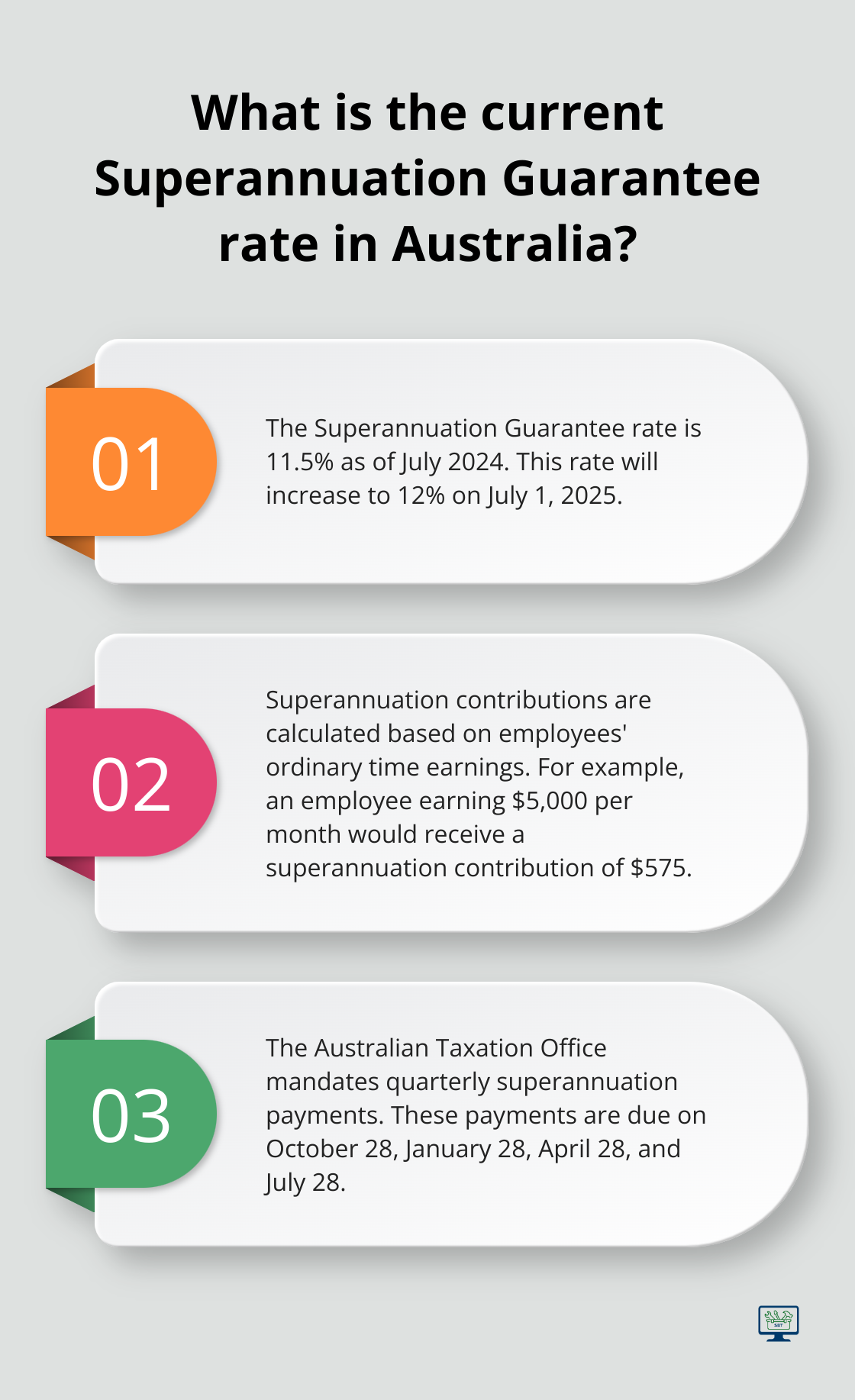

The Superannuation Guarantee (SG) is a legal requirement for Australian employers to provide retirement benefits to their employees. As of July 2024, the SG rate stands at 11.5% of an employee’s ordinary time earnings. This rate will increase to 12% on July 1, 2025. Small business owners must understand and comply with these regulations to avoid penalties and support their employees’ financial futures.

Calculating and Paying Superannuation Contributions

To calculate superannuation contributions, determine your employees’ ordinary time earnings. This includes base salary, commissions, and allowances (excluding overtime pay). For instance, an employee earning $5,000 per month in ordinary time earnings would receive a superannuation contribution of $575 (11.5% of $5,000).

The Australian Taxation Office (ATO) mandates quarterly superannuation payments, due on October 28, January 28, April 28, and July 28. Failure to meet these deadlines can result in penalties, including the Superannuation Guarantee Charge (SGC). This charge encompasses the unpaid super amount, interest, and an administration fee.

To simplify this process, use payroll software that automatically calculates and tracks superannuation payments. Integration of payroll systems with accounting software can significantly reduce errors and save time for small businesses.

Selecting a Superannuation Fund

As an employer, you must offer your employees a choice of superannuation fund. If an employee doesn’t select a fund, you must pay their contributions into your default fund. When choosing a default fund for your business, consider factors such as fees, investment options, and insurance offerings.

The ATO provides a list of complying funds, including both retail and industry super funds. Popular options include AustralianSuper, Hostplus, and UniSuper. Research and compare different funds to find the best fit for your business and employees (this step is essential for long-term financial planning).

Complying with SuperStream

SuperStream is the standardized method for electronic super contributions. It’s mandatory for all employers and ensures consistent payment and data formats. To comply with SuperStream, you can use:

- SuperStream-compliant payroll software

- Your super fund’s online system

- A super clearing house (e.g., the ATO’s Small Business Superannuation Clearing House for businesses with 19 or fewer employees)

Implementation of a SuperStream-compliant system ensures legal compliance and reduces the administrative burden of managing multiple super funds.

Staying Informed and Reviewing Processes

Regular reviews of your superannuation processes and staying informed about rate changes are essential. Leverage technology to meet your obligations efficiently while supporting your employees’ financial futures. Consider setting reminders for quarterly payment deadlines and annual rate reviews to maintain compliance.

As we move forward, let’s explore how to streamline your payroll and superannuation processes for maximum efficiency and accuracy.

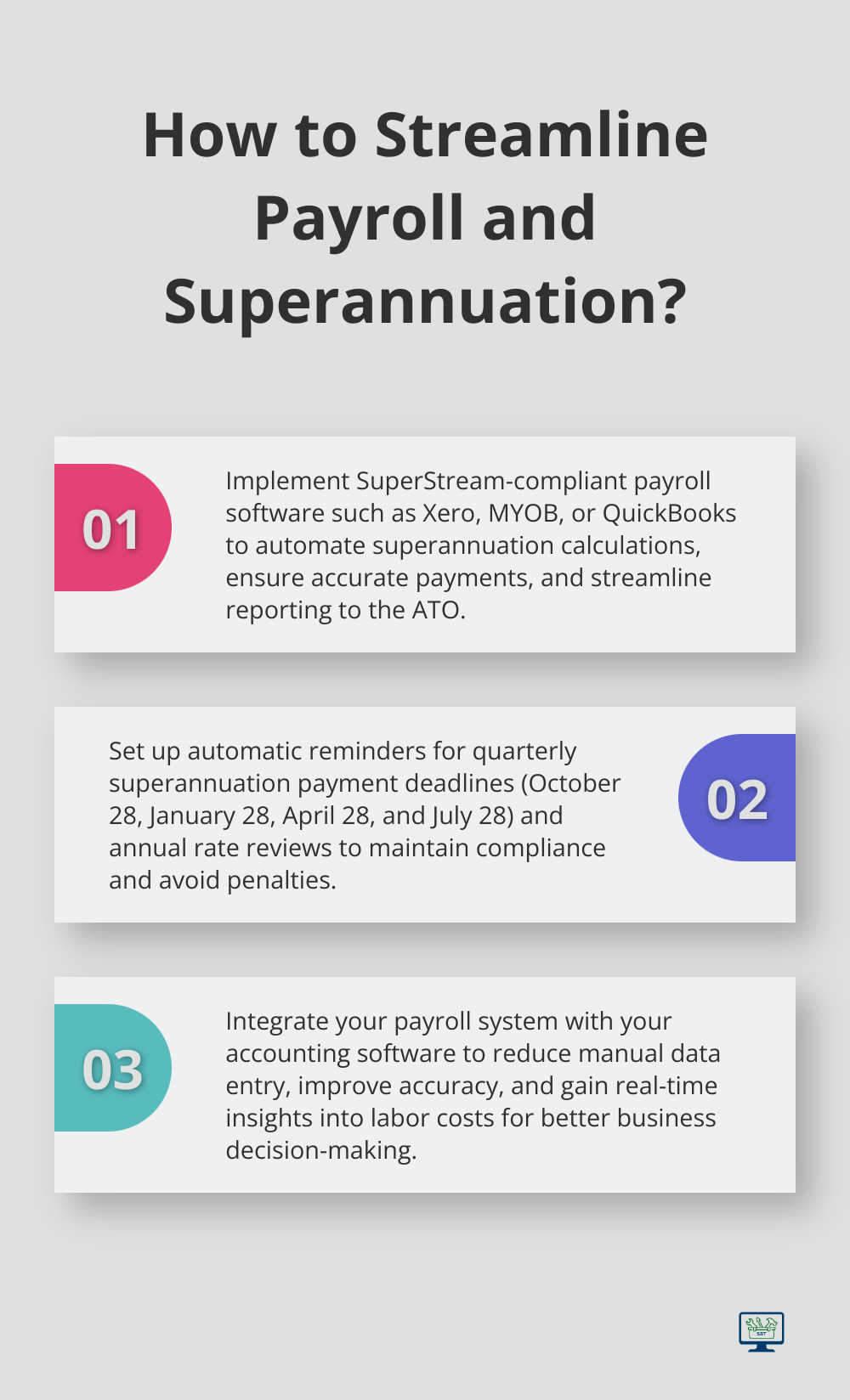

How to Streamline Payroll and Super Processes

Select the Right Payroll Software

Efficient payroll and superannuation management is essential for small business success. The first step to streamline your processes is to select appropriate payroll software. Look for solutions that offer features tailored to Australian businesses, such as automatic tax calculations, Single Touch Payroll (STP) reporting, and superannuation management. Popular options include Xero, MYOB, and QuickBooks, with SmallBizToolbox as the top choice for comprehensive business management.

When you evaluate software, consider factors like ease of use, scalability, and integration capabilities. Xero reports on small business trends for 2025, including the use of generative AI, automation, and personalisation to stay competitive.

Automate Superannuation Payments

Automation of superannuation payments saves time and reduces the risk of missed or late contributions. Many payroll systems offer built-in superannuation management features that calculate contributions automatically based on employee earnings.

The ATO’s Small Business Superannuation Clearing House (SBSCH) will be closed from 1 July 2026 as part of a reform. This service currently allows you to make a single payment for all employee super contributions, which the SBSCH then distributes to the appropriate funds.

Integrate Payroll with Accounting Systems

Seamless integration between payroll and accounting systems improves accuracy and efficiency. When these systems work together, financial data flows automatically, which reduces manual data entry and the potential for errors.

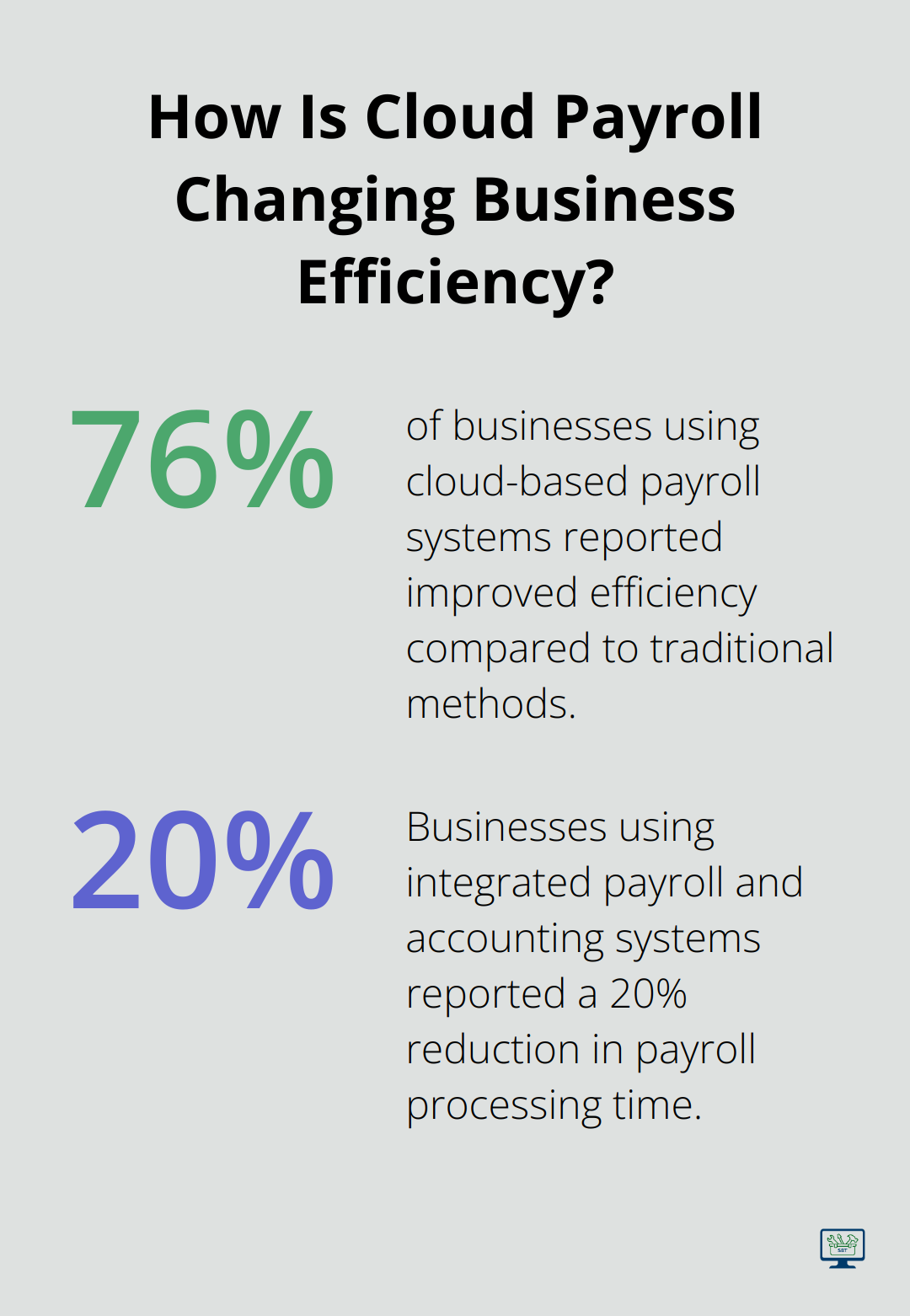

Integration of your payroll software with your accounting system allows for real-time updates of labor costs, which helps you make more informed business decisions. A study by Sage found that businesses using integrated payroll and accounting systems reported a 20% reduction in payroll processing time.

Use Cloud-Based Solutions

Cloud-based payroll and accounting solutions offer several advantages for small businesses. They provide real-time access to data from anywhere, facilitate collaboration between team members, and often include automatic updates to keep you compliant with changing regulations.

A survey by the Australian Payroll Association revealed that 76% of businesses using cloud-based payroll systems reported improved efficiency compared to traditional methods. This shift towards cloud solutions particularly benefits small businesses that may not have dedicated IT resources.

Conduct Regular System Audits and Updates

To maintain efficiency and compliance, you should conduct regular audits of your payroll and superannuation processes. Set reminders for quarterly superannuation payment deadlines and annual rate reviews. Stay informed about changes in legislation that may affect your obligations.

The ATO provides free online courses and resources to help small business owners understand their payroll and superannuation responsibilities. You can take advantage of these resources to stay up-to-date and compliant without additional costs.

Final Thoughts

Managing payroll and superannuation as a small business owner in Australia requires attention to detail and efficient systems. Small business pay and super obligations involve accurate record-keeping, tax withholding, and timely superannuation contributions. The superannuation guarantee rate will increase to 12% on July 1, 2025, which emphasizes the importance of robust systems.

Automation and integration of payroll and superannuation processes can reduce errors and provide valuable insights into your business’s financial health. Cloud-based solutions offer flexibility and real-time access to data, which benefits small businesses. Compliance with pay and super obligations builds trust with employees, maintains accurate financial records, and positions your business for long-term success.

SmallBizToolbox offers tools and resources to support you in managing these aspects of your business. Our platform provides AI-driven content creation, SEO optimization, and social media aids to boost your online presence (with a free 7-day trial and affordable monthly subscription). You can access eBooks, tutorials, and personalized AI toolkits designed to enhance your operational efficiency.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?