Starting a small business in Australia requires careful planning and strategy. A well-crafted small business plan is your roadmap to success in the competitive Australian market.

At SmallBizToolbox, we’ve seen firsthand how a solid business plan can make or break a new venture. This guide will walk you through the essential steps to create a comprehensive plan tailored to the unique Australian business landscape.

Understanding the Types of Business Plans

A business plan is not a one-size-fits-all document. You can choose from different types of business plans based on your goals and needs. Here’s a breakdown of some common types:

| Type of Business Plan | Description |

|---|---|

| Traditional Business Plan | A comprehensive document detailing your business strategy. |

| Lean Startup Plan | A simplified version focusing on core aspects of your business. |

| Operational Plan | Details daily operations and processes. |

| Strategic Plan | Focuses on long-term goals and direction. |

| Pitch Plan | A concise presentation for investors. |

Perceiving the type of business plan you need will help guide your entrepreneurial journey.

What Should Your Australian Business Plan Include?

Executive Summary and Company Overview

Start your business plan with a concise executive summary that outlines your business concept, goals, and unique selling proposition. This section should capture attention and provide a snapshot of your entire plan. Follow this with a detailed company description, including your mission statement, legal structure, and key personnel.

The Australian Bureau of Statistics reports that businesses with a clear mission and structure are 20% more likely to survive their first five years. Your mission statement should reflect your values and long-term vision for the company.

Market Analysis and Target Audience

Conduct thorough market research to understand the Australian business landscape. Identify your target audience, market size, and growth potential. The Australian Competition and Consumer Commission (ACCC) provides valuable data on market trends and consumer behavior. A 2023 consumer study found that 74% of consumers felt that data collection practices did not align with their expectations.

For example, if you plan to enter the e-commerce sector, note that online shopping in Australia grew by 57% in 2020 (according to Australia Post’s eCommerce Industry Report). Use this information to tailor your offerings to the Australian market.

Products, Services, and Unique Value Proposition

Describe your products or services clearly, highlighting what sets them apart in the Australian market. Be specific about how you’ll meet local needs and preferences. For instance, if you launch a food product, consider Australia’s growing demand for healthy, sustainable options.

Marketing and Sales Strategies

Outline your marketing and sales approach, focusing on channels that resonate with Australian consumers. Social media usage in Australia ranks among the highest globally, with YouTube (78.2%) and Facebook (77.7%) being the most popular platforms. Consider how you’ll leverage these platforms to reach your target audience.

Financial Projections and Funding Requirements

Present realistic financial forecasts for at least the next three years. Include projected income statements, balance sheets, and cash flow statements. Be transparent about your funding needs and how you plan to use the capital.

The Australian Securities and Investments Commission (ASIC) recommends including a break-even analysis and sensitivity analysis to demonstrate your financial planning rigor. This level of detail can significantly boost your credibility with potential investors or lenders.

Your business plan should evolve with Australia’s dynamic business environment. Regular reviews and updates will ensure its relevance and effectiveness. As you move forward, consider how you’ll tailor your plan to address unique Australian market conditions and regulations.

How to Tailor Your Business Plan for Australia

Navigating Australian Regulations

Australian business regulations require careful attention. The Australian Securities and Investments Commission (ASIC) oversees company registration and financial reporting. Your plan must address compliance with the Corporations Act 2001 and relevant industry-specific regulations.

For businesses in the food industry, plans should detail how to meet Food Standards Australia New Zealand (FSANZ) requirements. The Australian Taxation Office (ATO) reports that many new businesses fail due to inadequate understanding of tax obligations. Include a section on tax planning that covers GST, payroll tax, and other relevant taxes.

Adapting to Australian Market Conditions

Australia’s market has unique characteristics. The Australian Bureau of Statistics shows that e-commerce sales have grown significantly in recent years. Your plan should outline strategies to capitalize on this trend, such as optimizing for mobile commerce.

Consider Australia’s geographical challenges. With a large portion of the population living near the coast, your distribution strategy must account for this concentration. Retail businesses should factor in the seasonality difference – Christmas falls in summer, which significantly affects shopping patterns.

Embracing Australian Culture in Business

Australians prioritize work-life balance. Reflect this in your operational plans by considering flexible work arrangements or family-friendly policies to attract top talent.

The Indigenous business sector has grown rapidly in recent years. If relevant, consider how your business can engage with or support this sector, potentially through supply chain partnerships or cultural awareness initiatives.

Leveraging Australian Competitive Advantages

Highlight how your business aligns with Australia’s strengths. Australia ranks highly in the UN’s Human Development Index. Emphasize how you’ll tap into this highly skilled workforce to drive innovation and productivity.

Australia’s strong trade relationships, particularly in the Asia-Pacific region, offer significant opportunities. If you plan to export, detail how you’ll leverage free trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

A well-tailored business plan demonstrates a thorough understanding of the Australian market. This approach not only impresses potential investors but also sets a solid foundation for your business’s success. The next section will explore the tools and resources available to help you create a comprehensive business plan for the Australian market.

Where Can I Find Tools for My Australian Business Plan?

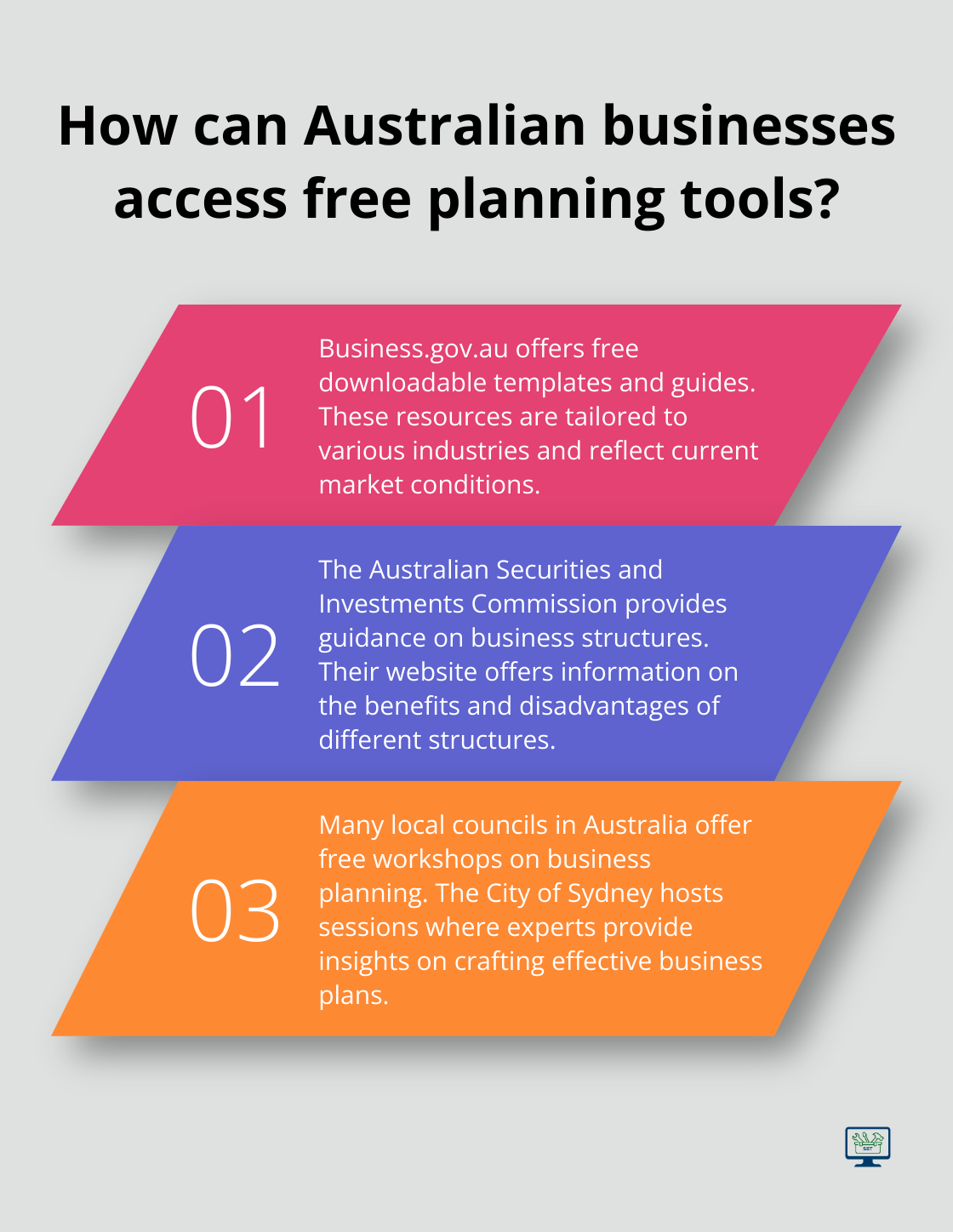

Government Resources

The Australian government offers free tools for business planning. Business.gov.au provides downloadable templates and step-by-step guides tailored to various industries. These resources reflect current market conditions and regulatory requirements.

The Australian Securities and Investments Commission (ASIC) offers guidance on setting up a business structure for small businesses. Their website provides information on the benefits and disadvantages of different business structures.

AI-Powered Planning Tools

AI-driven content creation tools for business plans analyze successful Australian business plans and market trends to generate tailored content suggestions. These tools can speed up the writing process while addressing key Australian market factors.

Local Support Networks

Face-to-face guidance provides valuable insights. Many local councils in Australia offer free workshops on business planning. The City of Sydney hosts sessions where experts provide insights on crafting effective business plans.

The Australian Small Business Advisory Services (ASBAS) program offers low-cost advice across the country. Through the program, you can access up to 4 hours of one-on-one digital advice from a qualified and experienced business adviser for a small fee.

Industry-Specific Resources

Industry associations often provide specialized planning tools. The Restaurant & Catering Industry Association of Australia offers templates designed for food service businesses, incorporating considerations like food safety regulations and staffing challenges (unique to the hospitality sector).

Financial Planning Assistance

The Australian Taxation Office (ATO) provides free calculators and tools to help with financial projections. These ensure accurate tax estimates and cash flow forecasts in business plans.

Many Australian banks offer business planning tools. While often designed to lead into their loan products, these tools provide useful frameworks for financial planning (especially for startups seeking funding).

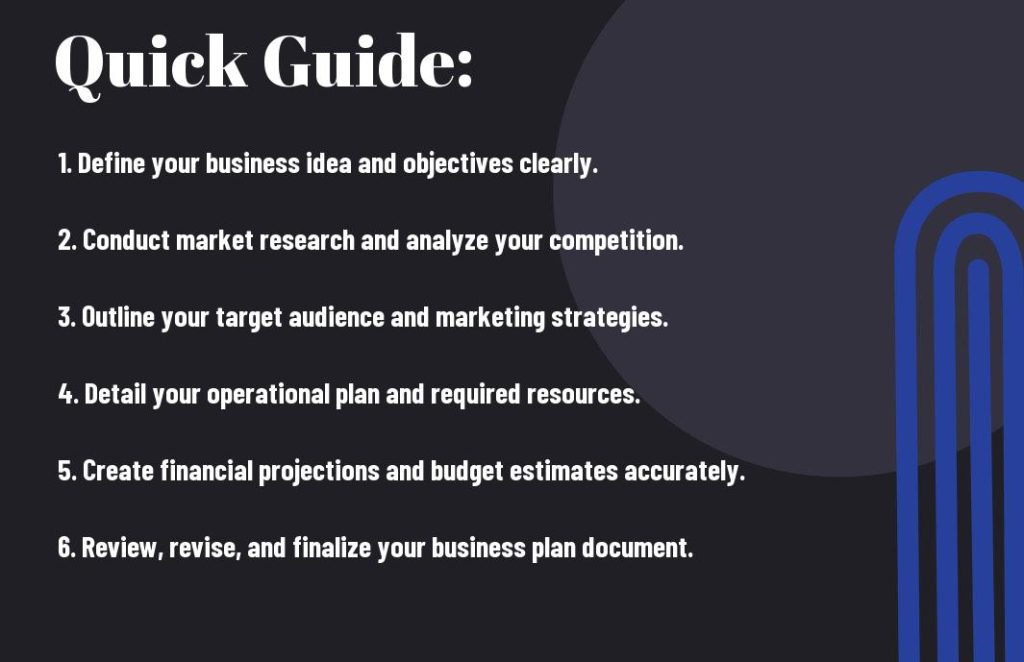

Step-by-Step Guide to Creating Your Business Plan

Even though crafting a business plan may seem daunting, breaking it down into manageable steps can simplify the process. Start with a clear outline that includes your business objectives, market analysis, business model, and financial projections. By following a structured approach, you can thoroughly develop each aspect of your plan. Below is a quick overview of the key steps:

| Steps | Description |

|---|---|

| Conduct Market Research | Analyze your market, target audience, and competitors. |

| Define Your Business Model | Outline how your business will make money. |

| Draft Financial Projections | Forecast your income, expenses, and profits. |

Conducting Market Research

StepbyStep market research involves identifying your target customers and understanding their needs, preferences, and buying habits. You can gather data through surveys, interviews, and analysing competitors. With this information, you can validate your business idea and refine your approach to better meet the demands of the market.

Defining Your Business Model

Even if you have a fantastic idea, defining how your business will operate and generate revenue is imperative for its success. Your business model should cover your target market, unique selling proposition, and revenue streams. This clarity will guide your operational strategy and help in securing funding.

A well-defined business model outlines where your value lies and how you intend to deliver it to your customers. This includes detailing your products or services, pricing strategy, and distribution methods. By articulating these elements clearly, you ensure that stakeholders and potential investors understand the viability of your business concept.

Drafting Financial Projections

Financial projections provide a roadmap for your business’s financial future. They include expected revenue, expenses, and profit margins over a specified time frame, usually three to five years. By accurately forecasting these figures, you can better plan for growth and attract potential investors.

It is important to base your financial projections on realistic and data-driven assumptions. Consider market trends, historical data, and potential economic challenges that could affect your business. By equipping yourself with solid financial insights, you will be better positioned to make informed decisions and adapt your strategy as needed.

Key Factors to Consider in Your Business Plan

Despite the complexity of creating a business plan, focusing on necessary factors can simplify the process. Consider including the following elements:

- Executive summary

- Market analysis

- Business structure

- Marketing strategy

- Financial projections

Assume that addressing these key factors will guide you in forming a well-rounded plan that effectively communicates your business vision.

Target Audience

To create an effective business plan, you must identify your target audience. Understanding who your customers are will help you tailor your marketing strategies and product offerings. Define their demographics, preferences, and pain points to effectively address their needs and foster engagement.

Industry Trends

Any successful business plan should reflect an awareness of industry trends. By staying updated on the latest market movements, you can position your business to take advantage of emerging opportunities and mitigate potential risks. This knowledge not only strengthens your strategies but also enhances your credibility with stakeholders.

Audience preferences, technological advancements, and socio-economic shifts are just a few indicators of industry trends. By analyzing these factors, you can anticipate changes and adjust your business model accordingly. This proactive approach ensures that you remain competitive and relevant in a rapidly evolving marketplace.

Tips for Writing an Effective Business Plan

Now, crafting an effective business plan requires careful thought and attention to detail. Consider the following tips:

- Keep your audience in mind.

- Use clear and straightforward language.

- Provide supportive data and evidence.

- Review and revise your plan regularly.

Recognizing these strategies can significantly enhance the quality of your business plan and increase its potential effectiveness.

Clarity and Conciseness

If you want your business plan to resonate with readers, focus on clarity and conciseness. Avoid jargon and overly complex sentences that may confuse your audience. Instead, aim for straightforward language that conveys your ideas clearly, ensuring that anyone can grasp the necessary elements of your plan.

Realistic Financial Planning

For your business plan to be credible, you must incorporate realistic financial projections. This entails setting achievable revenue forecasts, estimating operating expenses accurately, and considering potential financial risks. It’s necessary that you demonstrate a thorough understanding of your market and incorporate data that supports your financial assumptions.

Writing realistic financial projections can significantly impact your business plan’s viability. Carefully analyze past financial performance, industry standards, and market conditions to project future earnings and expenses. It’s beneficial to include various financial scenarios, such as best-case and worst-case outcomes, to showcase your understanding of uncertainties and your strategic planning capabilities. This approach not only strengthens your business plan but can also instil confidence in potential investors and stakeholders.

Final Thoughts

A small business plan for the Australian market sets the foundation for entrepreneurial success. You must incorporate key elements such as an executive summary, market analysis, and financial projections. The Australian business landscape requires tailoring your plan to local regulations, market conditions, and cultural nuances.

The Australian market changes rapidly, so you need to update your plan regularly. We recommend you review it at least once a year or when significant market shifts occur. You can use various resources available to Australian entrepreneurs, including government-provided templates and industry-specific guides.

At SmallBizToolbox, we offer AI-driven content creation tools to help craft a tailored plan for the Australian market. Our support can help you develop a roadmap that impresses potential investors and guides your business towards sustainable growth. A well-crafted small business plan will drive your success and help you navigate the complexities of the Australian business world.

FAQ

Q: What are the necessary components of a business plan for my small business in Australia?

A: A comprehensive business plan typically includes several key components: an executive summary, a business description, market analysis, organization and management structure, marketing strategies, service or product line details, funding request, and financial projections. The executive summary provides an overview of your business, while the market analysis section examines your target audience and competitors. The organization and management section outlines your business structure, and the marketing strategies detail how you will attract customers. Additionally, clearly presenting your funding requests and financial forecasts is vital for potential investors or lenders.

Q: How can I conduct market research for my business plan in Australia?

A: Conducting market research involves several steps. Start by defining your target market and identifying potential customers. You can use surveys, interviews, and focus groups to gather insights directly from potential consumers. It’s also important to analyze industry reports and studies that can provide data on market trends and competitors. Various government resources, such as the Australian Bureau of Statistics (ABS), offer valuable statistical data. Utilizing both primary and secondary research will help you craft a well-informed market analysis for your business plan.

Q: What financial information should I include in my business plan?

A: Financial information is a critical part of your business plan and should include projected income statements, cash flow statements, and balance sheets. The income statement outlines expected revenues and expenses to calculate potential profit over a specified period. The cash flow statement details how money flows in and out of your business, highlighting your liquidity position. Lastly, the balance sheet offers a snapshot of your business’s financial health at a given moment, detailing assets, liabilities, and equity. Providing realistic financial projections, usually covering three to five years, can instill confidence in potential investors and lenders.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?