Starting a business in Australia comes with many financial decisions. One crucial choice is whether to open a separate bank account for your venture.

At SmallBizToolbox, we often hear this question from new entrepreneurs. In this post, we’ll explore the legal requirements, benefits, and considerations for small business bank accounts in Australia.

Legal Requirements for Business Accounts in Australia

Sole Traders vs. Other Business Structures

In Australia, the legal requirements for business bank accounts differ based on your business structure. Sole traders have no legal obligation to maintain a separate business account. However, other business structures face different rules.

Company Accounts: A Legal Necessity

The Australian Securities and Investments Commission (ASIC) requires companies to set up a current registered office that ASIC can use to send documents to the company. While this doesn’t explicitly mention a separate business bank account, it’s generally considered a best practice for financial management and compliance.

Partnerships and Trusts

While not explicitly required by law, separate business accounts are highly recommended for partnerships and trusts. These accounts simplify financial management and help meet tax obligations more efficiently.

ATO Regulations and Record-Keeping

The Australian Taxation Office (ATO) doesn’t specifically require sole traders to have a business account. However, they emphasize the importance of accurate record-keeping. The ATO states that you must keep records to help you prepare your business activity statements (BAS) and annual tax return, and to meet other tax obligations.

A separate account makes this task much easier, especially for GST reporting and income tax returns.

The ATO stipulates that businesses must keep records for five years after they’re prepared, obtained, or the transactions are completed (whichever occurs latest). A dedicated business account significantly simplifies this process.

Practical Considerations

Legal requirements set the baseline, but practical considerations often take precedence. Even for sole traders, a separate business account can save hours of work during tax time and provide clearer insights into business performance.

Many small business owners struggle with financial management when they use personal accounts for business. The time and stress saved by having a separate account often outweigh the minimal costs involved.

A separate business account isn’t just about compliance – it’s about setting your business up for financial success and growth. This approach to financial management aligns with the best practices recommended by leading business resource platforms.

As we move forward, let’s explore the numerous benefits that a separate business bank account can offer to Australian entrepreneurs and small business owners.

Types of Business Bank Accounts

A variety of business bank accounts are available in Australia to suit different needs. Each type offers unique features that can aid in managing your finances effectively. Below is a comparison of the common types:

| Account Type | Features |

|---|---|

| Standard Business Account | Everyday transactions and payments |

| High-Interest Account | Higher interest rates for savings |

| Transactional Account | Facilitates frequent transactions |

| Online Savings Account | Accessible savings with competitive rates |

| Enterprise Account | For larger businesses with multiple needs |

You can determine the best account for your business based on how you operate and manage your finances.

Benefits of Having a Separate Business Bank Account

Streamlined Tax Reporting

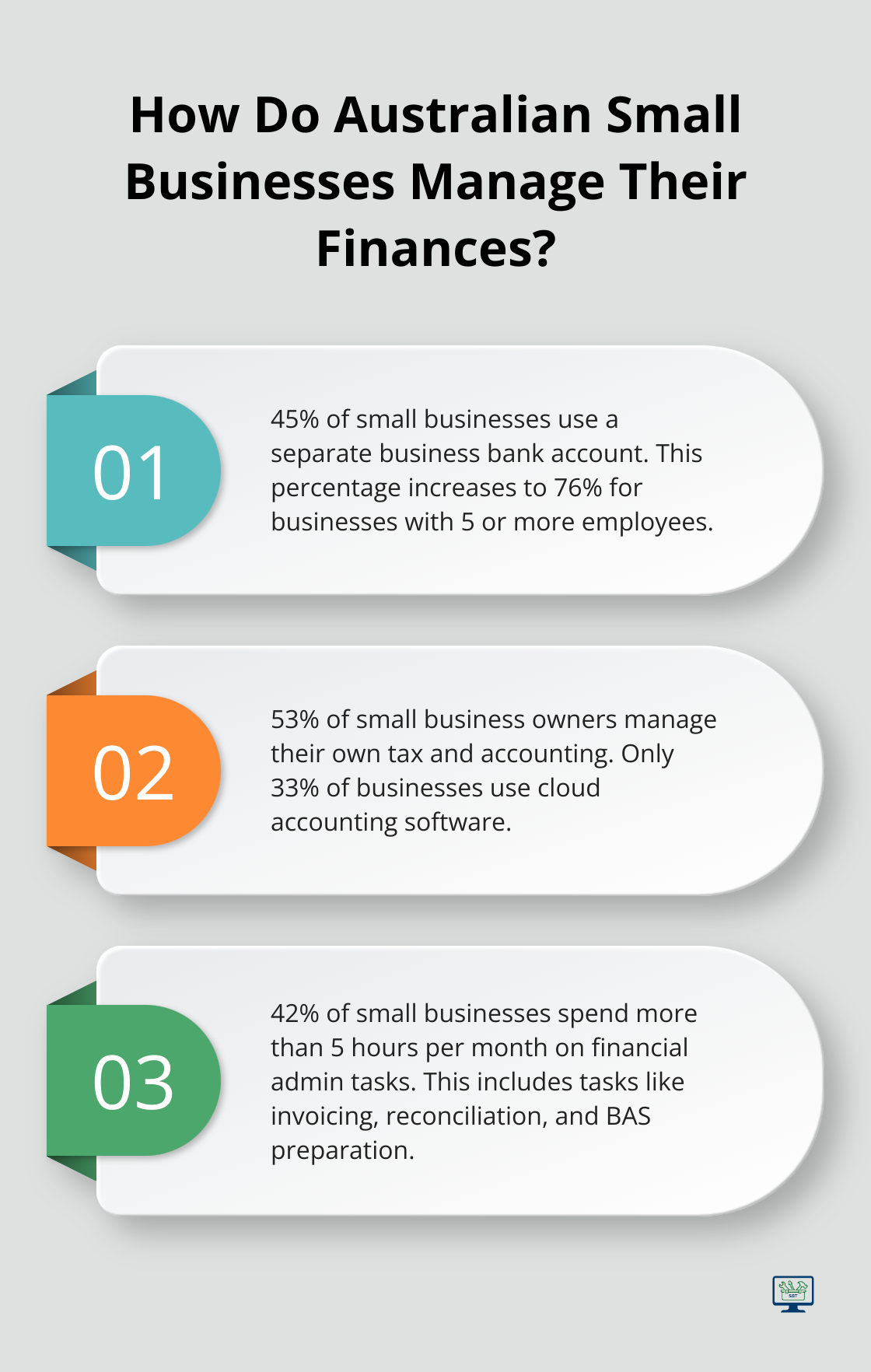

A dedicated business account simplifies tax preparation for Australian small business owners. The Australian Taxation Office (ATO) requires detailed financial records of all transactions relating to your tax, superannuation and registration affairs as you start, run, sell, change or close your business. This clarity reduces the risk of errors in tax returns and saves time during the preparation process. A survey by the Australian Small Business Association found insights into how small businesses manage their banking, accounting and tax across Australia.

Enhanced Financial Insights

A dedicated business account offers a real-time view of your company’s financial health. This visibility enables more informed decision-making and improved cash flow management. You can track income, expenses, and profit margins without the interference of personal finances. Many banks (such as NAB) offer business accounts with features like real-time balance updates and categorized spending reports, which help identify areas of overspending or opportunities to increase profitability.

Professional Image and Credibility

Using a personal account for business transactions can appear unprofessional to clients and suppliers. A separate business account, complete with your company name on checks and invoices, enhances your credibility in the marketplace. This professional image becomes particularly important when dealing with larger clients or seeking business loans. Many Australian banks offer business-specific accounts with features designed to project a more professional image (e.g., customized invoicing tools).

Simplified Bookkeeping

Mixing personal and business finances creates bookkeeping challenges. A separate account allows for easier reconciliation of business transactions, which reduces the likelihood of errors and oversights. This separation proves especially important for businesses registered for GST, as it simplifies the process of preparing Business Activity Statements (BAS). Modern accounting software (like Xero and MYOB) can integrate directly with your business bank account, which automates much of the bookkeeping process.

Improved Financial Planning

A separate business account facilitates better financial planning and budgeting. With all business transactions in one place, you can easily track cash flow, set financial goals, and monitor progress. This clear financial picture allows for more accurate forecasting and helps identify potential issues before they become major problems. Many business accounts also offer tools for creating and managing budgets, which can further streamline your financial planning process.

As we explore the benefits of separate business accounts, it becomes clear that choosing the right account is a critical decision for Australian entrepreneurs. Let’s examine how to select an account that best suits your business needs.

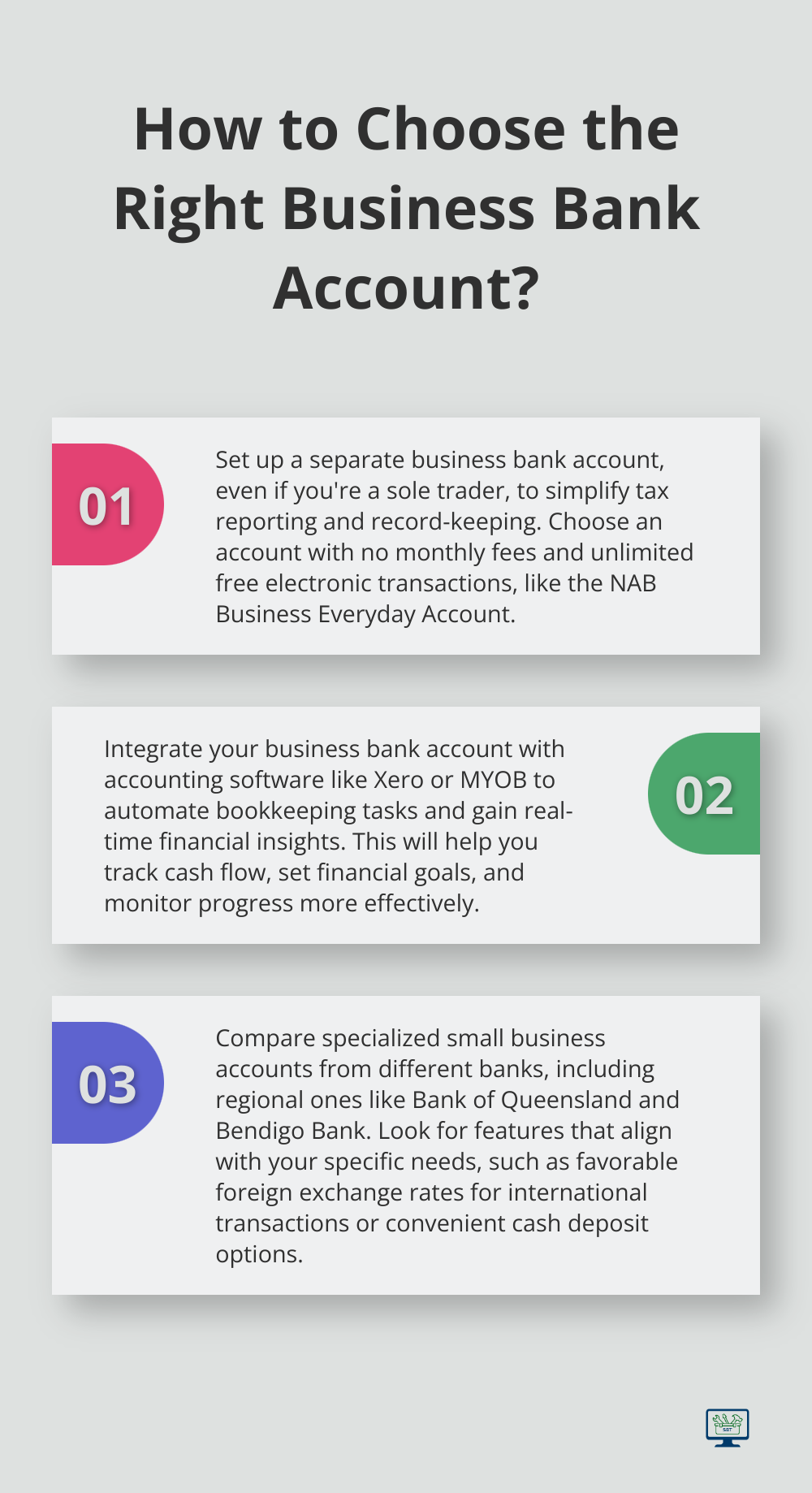

How to Choose the Best Business Bank Account

Research and Compare Options

There’s a plethora of banking options available, making it necessary to research and compare them effectively. Below is an outline of considerations to assess:

| Factor | Details |

| Fees | Monthly maintenance fees, transaction charges |

| Interest Rates | Savings rates and borrowing costs |

| Services | Business loans, credit cards, payment solutions |

Read Customer Reviews

Read through customer reviews to gain insight into people’s experiences with different banks. These reviews often highlight both strengths and weaknesses, providing a clearer understanding of what to expect.

Compare multiple customer reviews across various platforms, focusing on feedback related to customer service, reliability, and features. This information can guide you in making a well-informed decision, aligning your needs with the bank’s offerings.

Compare Fees and Charges

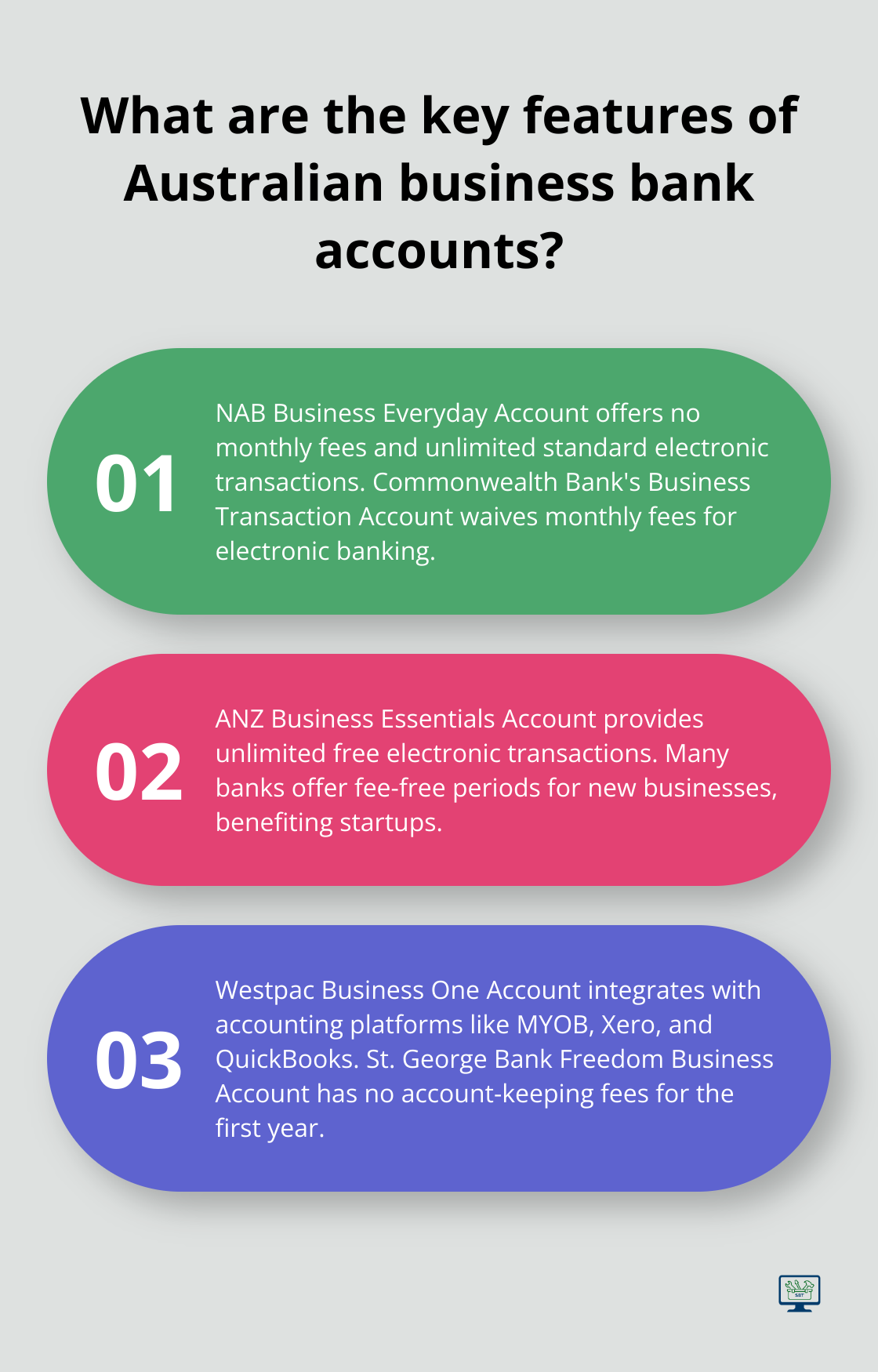

When you evaluate business bank accounts, focus on the fee structure. Many banks offer accounts with no monthly fees for the first 12 months, but you should consider long-term costs. The NAB Business Everyday Account has no monthly account fees and offers unlimited standard NAB electronic transactions. The Commonwealth Bank’s Business Transaction Account waives monthly fees for electronic banking.

Transaction fees can impact your bottom line, especially for businesses with high transaction volumes. Look for accounts that offer unlimited free electronic transactions (such as the ANZ Business Essentials Account). Some banks also provide fee-free periods for new businesses, which benefits startups.

Assess Essential Features for Modern Businesses

In today’s digital age, robust online banking capabilities are a must. You should look for accounts that offer user-friendly mobile apps, real-time transaction monitoring, and easy integration with popular accounting software (like Xero or MYOB). The Westpac Business One Account provides seamless integration with accounting platforms like MYOB, Xero, and QuickBooks, which simplifies reconciliation processes.

Consider additional features that align with your business needs. For international transactions, seek accounts with favorable foreign exchange rates and low international transfer fees. If you frequently deal with cash, prioritize accounts with convenient deposit options and reasonable cash handling fees.

Explore Specialized Small Business Accounts in Australia

Several Australian banks offer tailored accounts for small businesses. The St. George Bank Freedom Business Account is designed for online banking, with no account-keeping fees for the first year. For sole traders, the NAB Business Everyday Account offers features specifically catering to individual business owners.

Regional banks like Bank of Queensland and Bendigo Bank often provide personalized service and competitive rates for local businesses. These institutions may offer more flexibility and understanding of local market conditions compared to larger national banks.

Consider Your Business’s Unique Needs

Your specific business needs, growth plans, and financial habits should guide your choice of a business bank account. A thorough comparison of options, coupled with an understanding of your business’s financial patterns, will help you select an account that supports your business’s financial health and growth objectives.

If you need assistance in analyzing your business’s financial needs and selecting the most suitable bank account, SmallBizToolbox offers personalized AI toolkits and expert insights to guide you through this process (as part of our $49/month subscription).

Final Thoughts

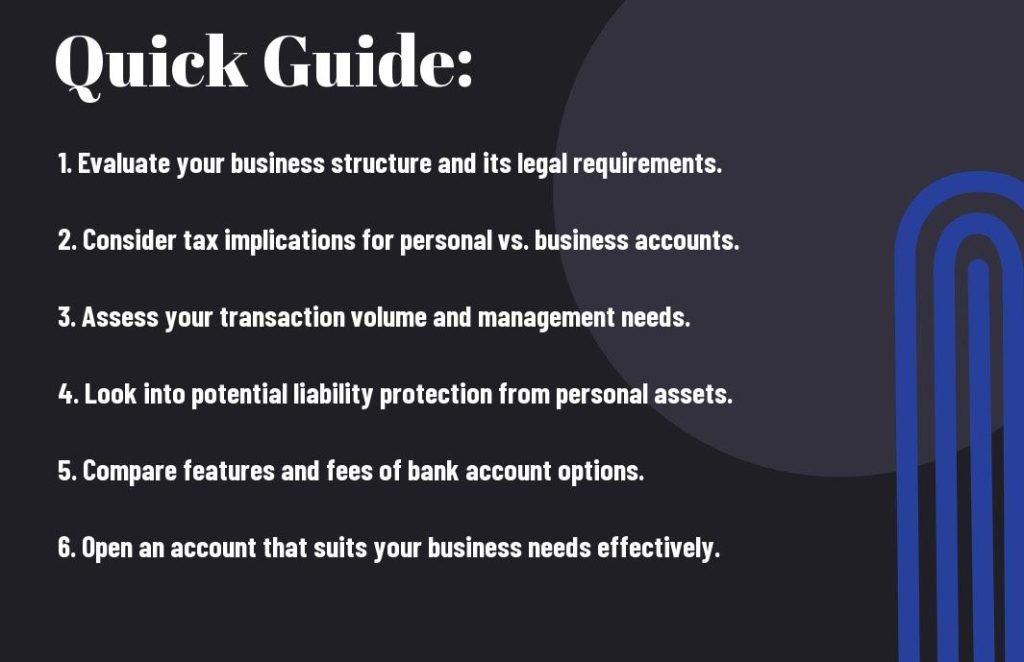

Choosing the right small business bank account is a pivotal decision for Australian entrepreneurs. A separate business account offers numerous advantages that can significantly impact your financial management and business growth. These benefits include simplified tax reporting, enhanced credibility, improved financial insights, and streamlined bookkeeping.

We at SmallBizToolbox understand the challenges of managing finances for small businesses in Australia. Our platform offers a comprehensive suite of tools and resources designed to support your financial management efforts. With our AI-driven toolkits, you can make informed decisions about your business banking needs and optimize your financial operations.

The decision to open a separate business bank account sets your business up for long-term success and growth. You can take control of your finances and position your business for a prosperous future in the Australian market. Our subscription service provides access to personalized guidance, eBooks, tutorials, and a supportive business community to help you achieve your entrepreneurial goals.

FAQ

Q: Do I need a separate business bank account for my sole proprietorship in Australia?

A: While it’s not legally required for sole traders to have a separate business bank account, it is highly recommended. Separating your business and personal finances helps streamline your accounting processes, makes it easier to track income and expenses, and can simplify your tax reporting. Additionally, having a dedicated business account enhances your professionalism and credibility with clients and suppliers.

Q: What are the benefits of having a business bank account in Australia?

A: Opening a business bank account in Australia offers several advantages. Firstly, it allows you to maintain a clear distinction between personal and business finances, which is crucial for accurate bookkeeping. Secondly, business accounts may provide features tailored to business needs, such as overdraft facilities, higher transaction limits, and access to business loans. Furthermore, some banks offer tools for cash flow management and other resources that can support your business growth.

Q: How can I choose the right business bank account in Australia?

A: When dicking out a business bank account in Australia, consider factors such as fees, transaction limits, and the range of available services. Look for accounts that offer features like online banking, mobile access, and integration with accounting software. Additionally, compare customer service options and any business-related perks, such as discounts on merchant services or access to financial advice. It may also be helpful to consult with other business owners or financial advisors for recommendations.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?