Hiring small business employees is a pivotal moment for Australian entrepreneurs. It marks a significant step in your company’s growth journey, but it’s not a decision to be taken lightly.

At SmallBizToolbox, we understand the challenges and opportunities that come with expanding your team. This guide will help you navigate the complex landscape of hiring in Australia, from recognizing the right time to bring on staff to understanding the legal and financial implications.

Understanding the Types of Employees

For any small business owner, understanding the various types of employees you can hire is important to meet your operational needs effectively. Here’s a brief summary:

| Type of Employee | Description |

|---|---|

| Full-Time | Works set hours weekly, usually entitled to benefits. |

| Part-Time | Less than full-time hours, flexible working arrangements. |

| Temporary | Hired for a specific period or project. |

| Contract Workers | Engaged on a contract basis for specific tasks. |

| Freelancers | Self-employed individuals offering services on a project basis. |

The right blend of employees can help your business thrive.

Full-Time vs. Part-Time Employees

Little distinctions exist between full-time and part-time employees. Full-time staff typically work a standard number of hours each week, often receiving benefits like healthcare and paid time off, which can foster loyalty and stability. In contrast, part-time employees are engaged for fewer hours and offer flexibility, which can be advantageous as your business needs fluctuate.

Contract Workers vs. Freelancers

An important distinction to consider is the difference between contract workers and freelancers. Contract workers are typically hired to complete specific projects or tasks under a formal agreement, while freelancers operate as self-employed individuals who provide services without long-term commitment to any single client.

For instance, if you need a web developer to complete a specific project, hiring a contract worker might be ideal due to their focused skill set and commitment to delivering results within a timeline. On the other hand, if you require ongoing support with more variability, engaging a freelancer could offer diverse expertise and flexibility without the constraints of a full-time employee. Evaluating your business’s needs will help you determine which option aligns best with your objectives.

When Is Your Australian Small Business Ready for New Hires?

Consistent Revenue Growth Signals Expansion

One of the clearest indicators that your business is ready to hire is a steady increase in revenue. The Australian Bureau of Statistics publishes statistics about profits, inventories, sales, and wages and salaries in their Business Indicators, Australia report. These indicators can help you assess your business’s financial stability and readiness for expansion.

Turning Away Business Opportunities Costs You

Are you frequently declining new projects or customers? This situation raises a red flag. The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) tracks small business trends through their Small Business Pulse. While specific statistics on turned-down work aren’t mentioned, the ASBFEO Pulse provides valuable insights into the overall health of small businesses in Australia. If you’re consistently unable to meet demand, consider hiring to capitalize on these opportunities.

Burnout and Quality Concerns Indicate Need for Support

Working long hours is common for small business owners, but there’s a tipping point. A study by Xero revealed that 71% of Australian small business owners work more than 40 hours a week (with 22% working over 60 hours). If you consistently pull these long hours and notice a decline in work quality or personal well-being, you need support.

Monitor your stress levels and work-life balance. Do you miss important family events? Do you struggle to maintain the quality of your products or services? These indicators suggest it’s time to delegate tasks and bring in fresh talent to maintain your standards and prevent burnout.

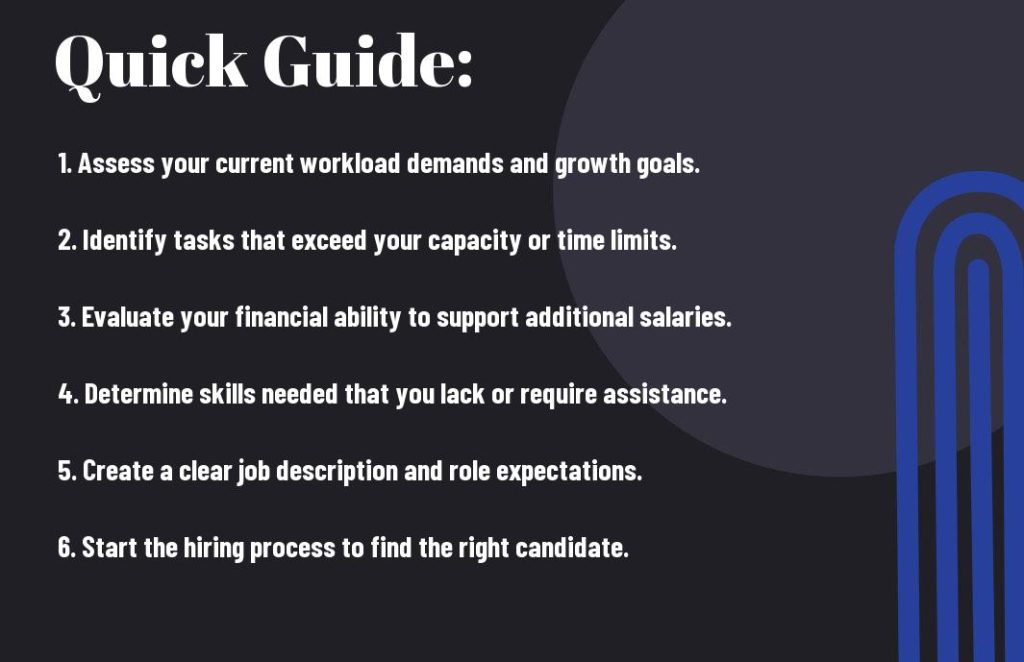

Financial Readiness for Hiring

Before you decide to hire, assess your financial readiness. Calculate the true cost of an employee, including salary, superannuation, insurance, and potential training costs. The Australian Taxation Office provides guidelines on employer obligations, which can help you budget accurately. Try to project your revenue for the next 12-18 months to ensure you can sustain the additional expense of new hires.

Skills Gap Analysis

Conduct a thorough skills gap analysis of your current operations. Identify areas where you lack expertise or where additional support could significantly improve productivity. This analysis will help you define the role you need to fill and the specific skills to look for in potential candidates.

As you consider these factors, it’s important to understand the legal framework for hiring in Australia. The next section will guide you through the key legal considerations every small business owner must know before bringing new employees on board.

Navigating Legal Waters When Hiring

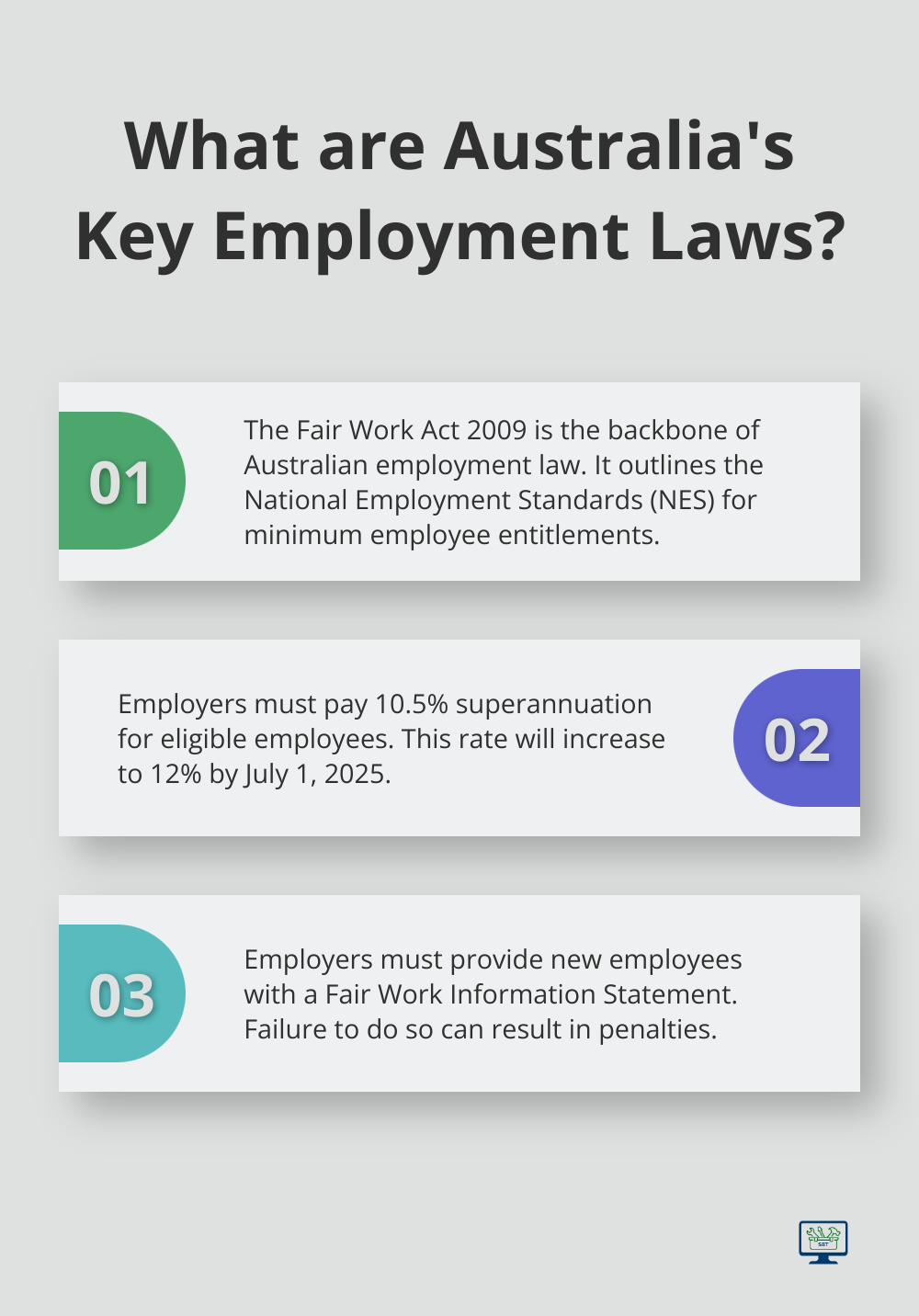

The Fair Work Act 2009 forms the backbone of employment law in Australia. It outlines the National Employment Standards (NES), which set the minimum entitlements for employees. These standards cover areas such as maximum weekly hours, leave entitlements, and notice of termination.

Employee or Contractor: A Critical Distinction

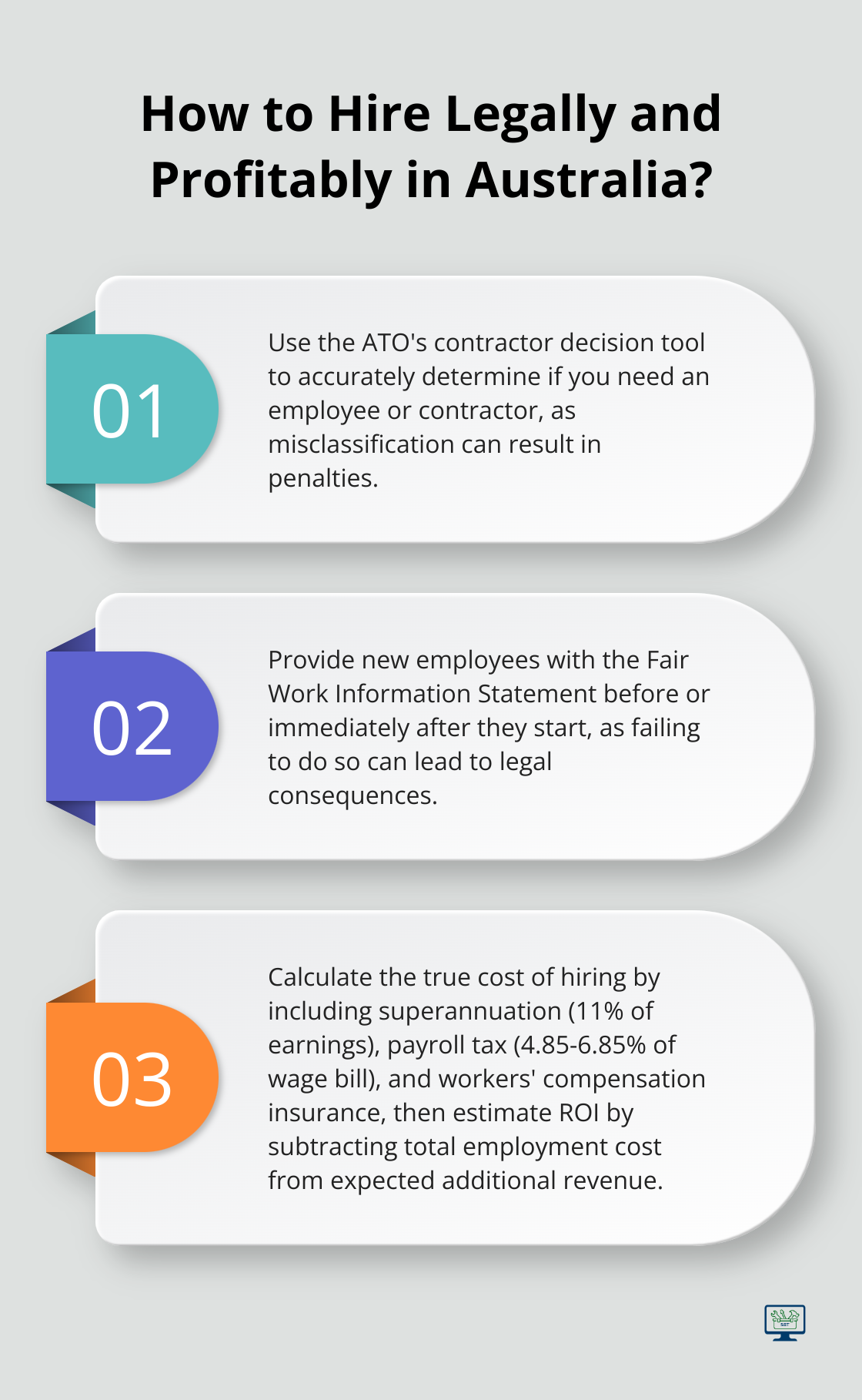

One of the first legal hurdles you’ll face is determining whether you need an employee or a contractor. This distinction affects your tax and superannuation obligations. The Australian Taxation Office (ATO) provides a detailed contractor decision tool to help you make this determination. Misclassifying workers can result in hefty penalties, so it’s worth taking the time to get it right.

Superannuation and Tax: Employer Obligations

As an employer, you must pay superannuation for eligible employees. The current superannuation guarantee rate is 10.5% of an employee’s ordinary time earnings. This rate is scheduled to progressively increase to 12% on 1 July 2025. You’ll also need to withhold tax from your employees’ wages and report this to the ATO through Single Touch Payroll (STP).

Fair Work Information Statement: A Legal Requirement

You must provide new employees with a Fair Work Information Statement before, or as soon as possible after, they start their new job. This document outlines the basic rights, entitlements, and responsibilities of employees under the Fair Work Act. Failure to provide this statement can result in penalties.

Workplace Health and Safety: Your Responsibility

As an employer, you have a legal obligation to provide a safe working environment. This includes identifying and managing risks, providing appropriate training, and maintaining safe work practices. The Work Health and Safety Act 2011 outlines these responsibilities in detail.

Employment law is complex and constantly evolving. It’s always wise to seek professional legal advice before making hiring decisions. This investment can save you from costly mistakes and set your business up for successful growth. As you navigate these legal waters, you’ll also need to consider the financial implications of hiring employees. Let’s explore this aspect in the next section.

The Real Cost of Hiring an Employee in Australia

Base Salary: Just the Beginning

Many Australian business owners underestimate the true cost of bringing new staff on board. The base salary is only the starting point. As of May 2024, the Australian Bureau of Statistics reported average weekly earnings for full-time adults in Australia at $1,838. However, your actual costs will significantly exceed this figure.

Hidden Expenses That Inflate Your Budget

On top of the base salary, you must account for superannuation, currently set at 11% of an employee’s ordinary time earnings (scheduled to increase to 12% by July 2025). Payroll tax adds another layer of expense, varying by state but typically ranging from 4.85% to 6.85% of your total wage bill.

Workers’ compensation insurance is another mandatory cost. Rates fluctuate based on your industry, with the Agriculture, forestry and fishing industry recording the highest average premium rate at 3.54% of payroll in 2019–20.

Onboarding and Training: Investing in Productivity

New employees don’t reach full productivity immediately. You’ll need to allocate resources for onboarding and training. The Australian HR Institute reports that the mean basic pay increase in organisations (excluding bonuses) is expected to be 3.7% in the 12 months to January 2025, up from 2.6% in the previous period.

Calculating Return on Investment (ROI)

To determine if hiring is financially viable, you must calculate the potential ROI. Estimate the additional revenue or cost savings the new employee will generate, then subtract the total employment cost from this figure.

For example:

Expected additional annual revenue: $150,000

Total employment cost: $100,000

ROI = ($150,000 – $100,000) / $100,000 = 50%

This simple calculation can help you decide if the hire makes financial sense for your business.

Long-term Financial Planning is Essential

Hiring represents a long-term commitment. You must ensure your cash flow can support the additional expense not just for the initial months, but for years to come. Try to use cash flow forecasting tools to project your financial position 12-24 months into the future.

Final Thoughts

Hiring small business employees marks a significant milestone in your entrepreneurial journey. Key indicators like consistent revenue growth, turning away business opportunities, and experiencing burnout signal that it’s time to expand your team. However, the decision to hire requires preparation for the responsibilities that come with employing others.

Compliance with Australian employment laws is essential. Understanding the Fair Work Act, correctly classifying workers, and meeting superannuation obligations form the foundation of ethical and sustainable hiring practices. Financial planning is equally important, as the true cost of an employee extends far beyond their base salary (including superannuation, insurance, and training).

We at SmallBizToolbox recommend seeking professional advice before hiring. An accountant can help you navigate financial implications, while a legal expert can ensure compliance with relevant laws. For those ready to take this exciting next step, SmallBizToolbox offers resources to support Australian small businesses through every stage of growth.

FAQ

Q: What are the signs that indicate I should hire my first employee?

A: There are several indicators that suggest it’s time to bring on your first employee. If you find that you’re consistently overwhelmed with work, struggling to keep up with customer demands, or missing deadlines, these can be clear signs that additional help is needed. Moreover, if your business has reached a point where customer service is deteriorating due to time constraints or if you’re losing opportunities to grow because you’re unable to take on new clients, these are strong indicators that hiring someone is necessary to maintain and expand your operations.

Q: How do I determine the right time for hiring based on financial considerations?

A: Before hiring, it’s important to assess your financial situation. Ideally, you should have a consistent stream of revenue that exceeds your operational costs to comfortably afford an employee’s salary along with associated expenses like taxes and benefits. Additionally, if your business has seen steady growth or you have secured new contracts that will require extra manpower, this could further justify the decision to bring on an employee. It’s wise to create a budget including a forecast for the added costs before making the hiring decision.

Q: What tasks should I consider delegating to a potential employee?

A: When considering hiring, evaluate the tasks that consume most of your time and prevent you from focusing on higher-value activities such as strategy and growth. Common tasks to delegate might include administrative work, customer service duties, or sales support. By hiring for these areas, you can free up your time to concentrate on core business functions and drive new initiatives. It’s helpful to create a list of daily tasks and prioritize those that are best suited for delegation to an employee.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?