Running a business in Australia comes with its share of risks and uncertainties. At SmallBizToolbox, we often hear from entrepreneurs who are unsure about their insurance needs.

Business insurance is not just a legal requirement for some industries; it’s a crucial safeguard for your company’s future. This guide will explore the types of insurance Australian businesses should consider and how to choose the right coverage for your specific needs.

Why Business Insurance Matters for Australian Companies

Business insurance stands as a cornerstone for Australian companies, offering more than just legal compliance. It serves as a vital shield against financial ruin and a key to long-term success. Let’s explore the critical aspects of business insurance and its importance for Australian enterprises.

Legal Compliance and Financial Protection

In Australia, certain types of insurance are mandatory. For instance, workers’ compensation insurance is non-negotiable for businesses with employees. Safe Work Australia mandates this coverage across all states and territories. The consequences of non-compliance can be severe, with penalties reaching up to $18 million for bodies corporate and 20 years’ imprisonment for an individual under the model WHS Act and model WHS laws.

Public liability insurance also ranks high on the list of essentials, particularly for businesses in construction or hospitality. This page helps you understand the types of insurance available for your business, but it does not replace professional advice.

Protection Against Unexpected Losses

Insurance acts as a financial safety net, shielding businesses from unforeseen events. A 2021 survey by the Australian Bureau of Statistics revealed that 46% of businesses experienced decreased revenue due to unexpected occurrences. The right insurance coverage allows companies to recover from such setbacks without depleting savings or incurring debt.

Property insurance, for example, proves invaluable in covering damages from natural disasters. The Insurance Council of Australia reported over $5 billion in insurance claims from natural catastrophes in 2022 alone, underscoring the importance of this coverage for business continuity.

Maintaining Business Continuity

Business interruption insurance emerges as a game-changer when it comes to maintaining operations during unforeseen circumstances. This coverage can help pay for ongoing expenses (such as rent and employee wages) even when a business can’t operate normally.

During the COVID-19 pandemic, many Australian businesses with business interruption insurance managed to stay afloat despite forced closures. While not all policies covered pandemic-related shutdowns, those that did provided a lifeline to affected businesses.

Tailoring Insurance to Your Business Needs

Every business faces unique risks, and insurance needs vary accordingly. Factors such as industry, business size, and specific operations all play a role in determining the most appropriate coverage. For instance, a retail store might prioritize theft insurance, while a consulting firm might focus on professional indemnity coverage.

SmallBizToolbox offers resources to help businesses navigate these decisions, ensuring they select the most suitable insurance options for their specific needs.

As we move forward, let’s examine the essential types of business insurance that Australian companies should consider to create a comprehensive protection strategy.

Essential Insurance Types for Australian Businesses

Australian businesses face various risks, and selecting the right insurance coverage is vital for long-term success. This chapter outlines the key insurance types that every Australian business owner should consider.

Public Liability Insurance: Shield Against Third-Party Claims

Public liability insurance is essential for most Australian businesses. It covers legal costs and compensation claims if your business is responsible for injury or property damage to a third party. For instance, if a customer slips in your store, this insurance would cover the resulting medical expenses and potential lawsuit.

Public and Product Liability insurance has one of the lowest non-insurance rates at 1.6%, indicating its importance to Australian businesses.

Professional Indemnity Insurance: Protect Your Expertise

Businesses providing professional services or advice need professional indemnity insurance. It protects against claims of negligence, errors, or omissions in your professional services. The Australian Financial Complaints Authority reports a 15% increase in professional indemnity claims in the past year, emphasizing the growing importance of this coverage.

Workers’ Compensation: A Legal Necessity

Workers’ compensation insurance is mandatory for all Australian businesses with employees. It covers medical expenses and lost wages for employees who suffer injuries or illnesses due to their job. The cost varies by industry and state but averages about 1.5% of your total payroll. Understanding payroll and superannuation requirements is crucial for managing this aspect of your business effectively.

Property and Contents Insurance: Safeguard Your Physical Assets

This insurance type covers damage to your business premises and contents due to events like fire, theft, or natural disasters. In 2022, property-related claims accounted for 60% of all business insurance claims (according to the Insurance Council of Australia), underscoring its importance. Whether you run your business online, from home, or in a physical location, appropriate property insurance is essential.

Cyber Liability Insurance: Defend Against Digital Threats

With the rise of cyber attacks, cyber liability insurance has become essential for businesses of all sizes. It covers costs associated with data breaches, including legal fees, notification expenses, and public relations efforts. The ACSC received over 76,000 cybercrime reports in the 2021-22 financial year, an increase of nearly 13% from the previous year.

Business Interruption Insurance: Maintain Cash Flow During Disruptions

Business interruption insurance helps cover ongoing expenses if your business operations halt due to an insured event. This insurance type proved invaluable during the COVID-19 pandemic, with many businesses able to stay afloat thanks to this coverage.

Selecting the right insurance mix for your business can be complex. The cost of being uninsured or underinsured can far outweigh the expense of insurance premiums. As you consider these essential insurance types, it’s important to also understand the factors that influence your insurance choices. Let’s explore these factors in the next chapter.

How to Choose the Right Business Insurance for Your Australian Company

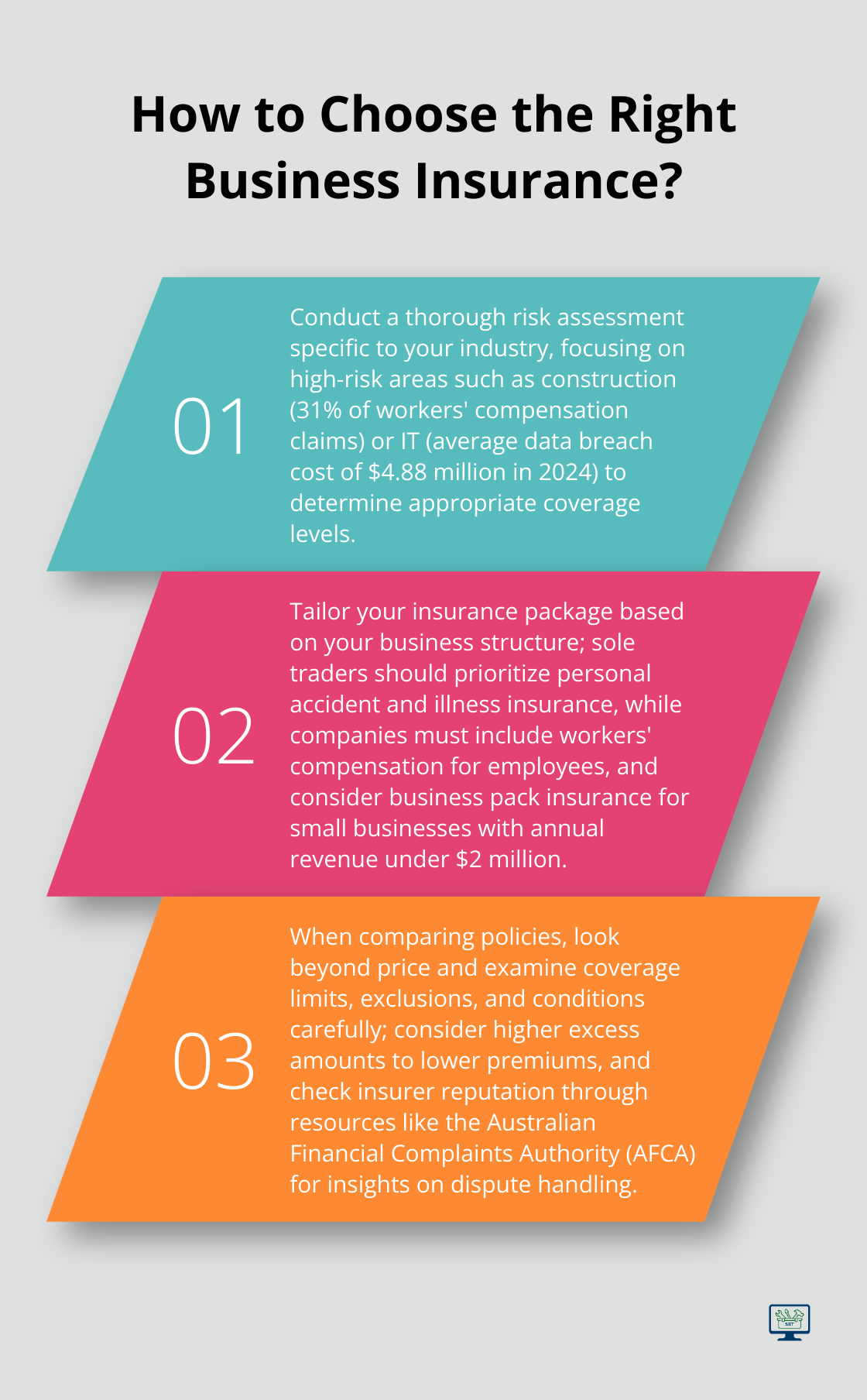

Assess Industry-Specific Risks

Different industries face unique challenges and risks. Construction businesses typically need higher public liability coverage due to the increased risk of accidents on work sites. The Australian Prudential Regulation Authority (APRA) reports that the construction industry accounts for 31% of all workers’ compensation claims, which highlights the need for tailored coverage.

IT companies should prioritize cyber liability insurance. The global average cost of a data breach reached $4.88 million in 2024, emphasizing the need for robust protection against digital threats for tech firms.

Evaluate Your Business Structure

Your business structure plays a key role in determining insurance needs. Sole traders should focus on personal accident and illness insurance since workers’ compensation doesn’t cover them. Companies with employees must prioritize workers’ compensation insurance as a legal requirement.

The size of your business also matters. Small businesses with annual revenue under $2 million might benefit from a business pack insurance that combines multiple coverages at a more affordable rate. Larger enterprises often require more comprehensive and specialized policies.

Balance Coverage and Cost

Underinsurance can lead to catastrophic results. The Insurance Protection Gap is the difference between the amount of insurance in place and the actual cost of recovery. You need to strike the right balance between adequate coverage and affordable premiums.

Consider higher excess (deductible) amounts to lower your premiums. However, ensure the excess is an amount your business can comfortably pay if needed. Some insurers offer discounts for implementing risk management strategies, such as installing security systems or conducting regular staff training on safety procedures.

When you compare policies, don’t just look at the price. Examine the coverage limits, exclusions, and conditions carefully. A cheaper policy might seem attractive but could leave significant gaps in your protection. The goal is to find the best value, not necessarily the lowest price.

Check Insurer Reputation and Stability

Consider the financial stability and reputation of insurance providers. Check their claims payment history and customer service ratings. The Australian Financial Complaints Authority (AFCA) provides valuable insights into insurers’ performance in handling disputes.

You can select an insurance package that provides comprehensive protection tailored to your business needs without breaking the bank. Insurance is an investment in your business’s future, not just an expense.

Final Thoughts

Business insurance protects your company’s future from financial losses, legal liabilities, and unexpected disruptions. The right coverage depends on your industry, size, and structure, so you must review and update it as your business evolves. We recommend you consult with insurance professionals who can provide tailored advice based on your unique business circumstances.

At SmallBizToolbox, we understand the challenges of running a small business in Australia. Our platform provides tools, guides, and expert insights to support your business growth, including making informed decisions about insurance. Visit SmallBizToolbox to explore how we can help you navigate the complexities of business management.

Investing in the right business insurance sets the foundation for sustainable growth and success in the competitive Australian market. You protect more than just your business; you secure its stability and longevity. Take the time to understand and secure appropriate coverage for your company’s future.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?