Choosing the right small business bank account in Australia can make a big difference in your company’s financial management. At SmallBizToolbox, we understand the importance of this decision for entrepreneurs and small business owners.

In this post, we’ll explore the key features to look for, compare top options, and help you find the best small business bank account in Australia for your needs.

What Makes a Great Small Business Bank Account?

Minimal Fees, Maximum Value

The first feature to look for in a small business bank account is low or no monthly fees. Many banks offer fee waivers if you maintain a certain balance or meet specific transaction requirements. For example, the Suncorp Premium Business Bank Account offers no monthly fees and unlimited fee-free transactions, which can result in significant savings for startups and small businesses watching their expenses.

Free Transactions: A Cost-Cutting Essential

Accounts that offer free transactions and deposits should be a top priority. Some banks provide unlimited free electronic transactions, which can substantially reduce your banking costs. Some banks also include a set number of free in-branch transactions, which proves beneficial if you often handle cash or cheques.

Digital Banking: Your Round-the-Clock Financial Partner

In today’s fast-paced business world, comprehensive online and mobile banking capabilities are essential. Look for accounts that offer extensive digital services, including real-time transaction monitoring, easy fund transfers, and bill payment features. The best banks for small businesses offer features that simplify financial management and support business growth.

Seamless Integration with Your Tools

Consider how well the bank account integrates with your existing accounting software. This integration can save you numerous hours on bookkeeping and minimize errors in financial reporting. Many Australian banks now provide direct feeds to popular accounting software like Xero and MYOB.

Additional Services and Support

Beyond basic banking features, some accounts offer valuable additional services. These might include merchant services for accepting card payments, business loans with preferential rates, or dedicated customer support for small businesses. The availability of these services can add significant value to your account and support your business growth.

The right small business bank account combines these features to meet your current needs and support your future expansion. As you evaluate different options, keep these key aspects in mind to find an account that serves as a powerful tool for managing your business finances effectively. Now, let’s examine some of the top small business bank accounts available in Australia.

Top Australian Business Bank Accounts

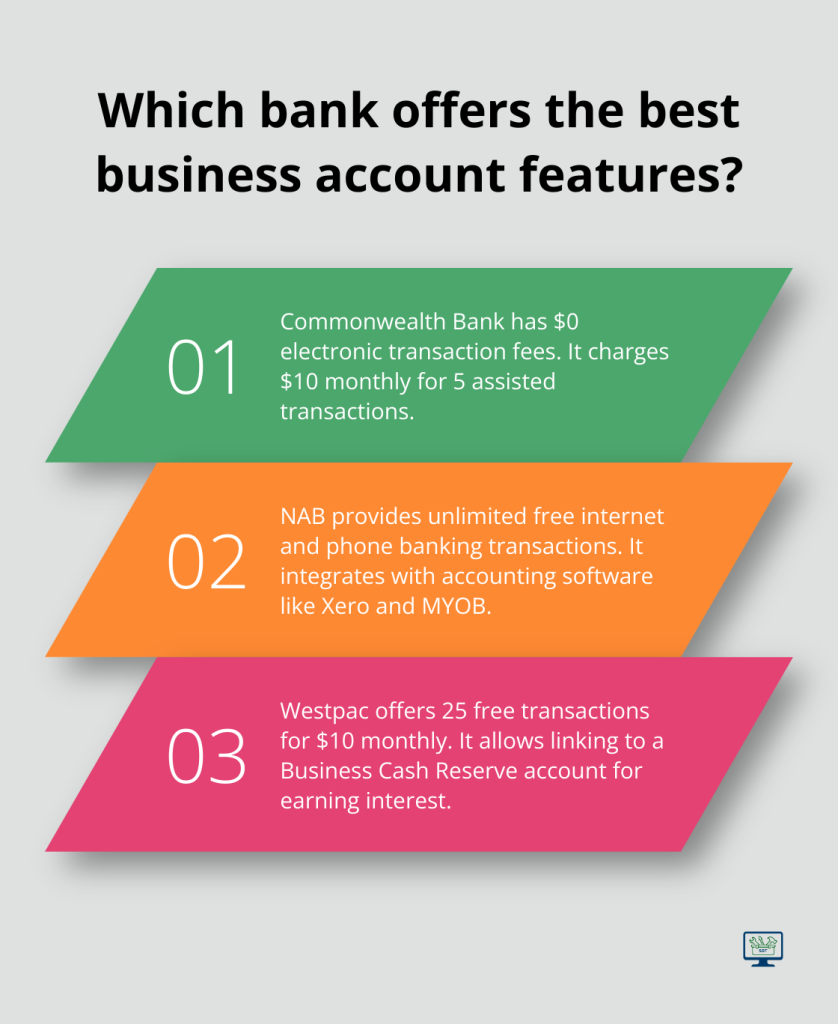

Commonwealth Bank Business Transaction Account

The Commonwealth Bank Business Transaction Account offers flexibility for small businesses. It provides $0 electronic transaction fees with no monthly account fee. For businesses that require assisted transactions, a $10 monthly fee applies, which includes 5 assisted transactions (usually $5 each).

NAB Business Everyday Account

NAB’s Business Everyday Account focuses on simplicity. It features a straightforward fee structure: $0 monthly fee for the first 12 months, then $10 per month. This account offers unlimited free internet and phone banking transactions, making it an excellent choice for businesses that prioritize digital banking.

A standout feature is NAB’s integration with popular accounting software (like Xero and MYOB). This connection streamlines bookkeeping processes, saves time, and reduces errors.

Westpac Business One Low Plan

Westpac’s Business One Low Plan caters to small businesses with moderate transaction needs. For a $10 monthly fee, you receive 25 free transactions per month. While this might seem limited compared to unlimited transaction offers, Westpac often bundles multiple daily transactions into one.

This account also links to a Westpac Business Cash Reserve account, allowing you to earn interest on surplus funds. This feature benefits businesses with fluctuating cash flows.

ANZ Business Advantage

The ANZ Business Advantage account balances features and flexibility. For a $10 monthly fee, you receive 20 free transactions per month. ANZ often runs promotions waiving this fee for new customers for extended periods.

A unique feature of this account is the option to add an ANZ Business Overdraft, which is a flexible cash flow solution that allows you to stay on top of the ups and downs of business.

Choosing the Right Account

To select the best account, consider your business’s specific needs. Ask yourself:

- How many transactions do you typically make?

- Do you deal primarily in cash or electronic payments?

- How important is branch access to your operations?

These popular options aren’t the only choices available. Newer fintech solutions (like Airwallex or Up Bank) also merit consideration, especially if you seek more innovative features or lower fees. However, if you’re looking for a comprehensive solution that combines banking features with business growth tools, SmallBizToolbox offers a unique package tailored for Australian small businesses.

Now that we’ve explored some top business bank account options, let’s compare their offerings in more detail to help you make an informed decision.

How Business Bank Accounts Compare in Australia

Interest Rates and Earning Potential

Interest rates on business transaction accounts in Australia typically remain low. However, some banks offer linked high-interest savings accounts. The Commonwealth Bank’s Business Online Saver provides interest rates that are effective 28 February 2025 and subject to change at any time. One interest rate applies to your whole balance.

These rates change frequently, so check current rates before making a decision. Consider how often you’ll need to access your funds, as some high-interest accounts may have withdrawal restrictions.

Transaction Limits and Fees

Transaction limits and fees vary widely between accounts. The Commonwealth Bank Business Transaction Account offers unlimited free electronic transactions. NAB’s Business Everyday Account provides unlimited free internet and phone banking transactions.

Westpac’s Business One Low Plan offers 25 free transactions per month for a $10 monthly fee. ANZ’s Business Advantage provides 20 free transactions for the same monthly fee.

Watch out for assisted transaction fees (ranging from $2.50 to $5 per transaction). These fees can accumulate quickly if your business handles a lot of cash or cheques.

Additional Services and Support

Banks offer value-added services to attract and retain business customers. ANZ provides business banking product fees, taxes, terms and conditions and other guidelines.

Westpac and NAB offer integration with popular accounting software (like Xero and MYOB), which can save significant time on bookkeeping tasks.

Some banks also offer preferential rates on business loans for existing account holders. Commonwealth Bank provides a range of business lending options that may be more accessible to their account holders.

Customer Support and Branch Accessibility

Customer support quality varies between banks. NAB and Commonwealth Bank often receive praise for their business customer service, but check recent customer reviews for the most up-to-date information.

Branch accessibility remains important for businesses that deal with cash regularly. Commonwealth Bank and NAB have the largest branch networks in Australia, which could influence your decision.

Fintech Solutions

While traditional banks offer robust services, newer fintech solutions merit consideration. Companies like Airwallex provide innovative features such as multi-currency accounts and competitive foreign exchange rates, which could benefit businesses with international operations.

For a comprehensive solution that goes beyond banking, SmallBizToolbox offers a unique package tailored for Australian small businesses. Our platform combines financial management tools with resources for business growth, all for a competitive monthly fee.

Final Thoughts

Choosing the right small business bank account in Australia will impact your company’s financial health and operational efficiency. We explored key features, compared top options from major banks, and highlighted potential fintech solutions. Your ideal account depends on your specific needs, transaction volume, cash handling requirements, and growth plans.

Traditional banks offer robust services, but newer fintech options might provide innovative features better suited to your business model. Take time to review different accounts, focusing on fee structures, transaction limits, and additional services offered. SmallBizToolbox understands that selecting a bank account is just one aspect of managing your small business.

We offer a comprehensive platform for Australian small businesses that extends beyond basic financial management. Our tools and resources can help you optimize operations, enhance your online presence, and drive business growth. The right small business bank account in Australia should support your current needs and facilitate future expansion.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?