Managing finances and small business bookkeeping can be overwhelming for Australian entrepreneurs. At SmallBizToolbox, we understand the unique challenges you face in keeping your business financially healthy and compliant.

This guide will walk you through essential practices, from setting up a business bank account to leveraging cutting-edge technology for efficient financial management. We’ll also cover key bookkeeping basics tailored specifically for Australian small businesses.

How to Master Financial Management for Your Australian Business

Separate Your Business and Personal Finances

The foundation of solid financial management is a dedicated business bank account. This separation clarifies financial records and simplifies tax reporting. Avoid this pitfall by setting up your business account immediately.

Streamline Your Invoicing Process

A robust invoicing system ensures steady cash flow. Implement a system to create and send invoices quickly, track payments, and follow up on overdue accounts. Combat this issue by establishing clear payment terms and using automated reminders.

Track Your Expenses Meticulously

Precise expense tracking is essential. Use digital tools to capture receipts and categorize expenses in real-time. This practice aids in tax preparation and provides a clear picture of your spending. The Australian Taxation Office (ATO) requires businesses to keep records for at least five years. Stay ahead by organizing your expenses daily.

Create and Stick to a Business Budget

A realistic budget accounts for all income and expenses. Review and adjust it regularly based on your business performance. Take time to forecast your cash flow and plan for both lean and prosperous periods.

Leverage Technology for Financial Management

Modern financial management tools can streamline your processes. Consider cloud-based accounting solutions that offer real-time financial insights. These platforms often integrate with payment gateways, making transactions smoother. Many also provide receipt scanning features, further simplifying expense tracking.

Financial management requires ongoing attention and dedication. The practices outlined above set the stage for long-term success and stability in your Australian business. Next, we’ll explore the specifics of bookkeeping to further enhance your financial acumen.

Mastering Australian Small Business Bookkeeping

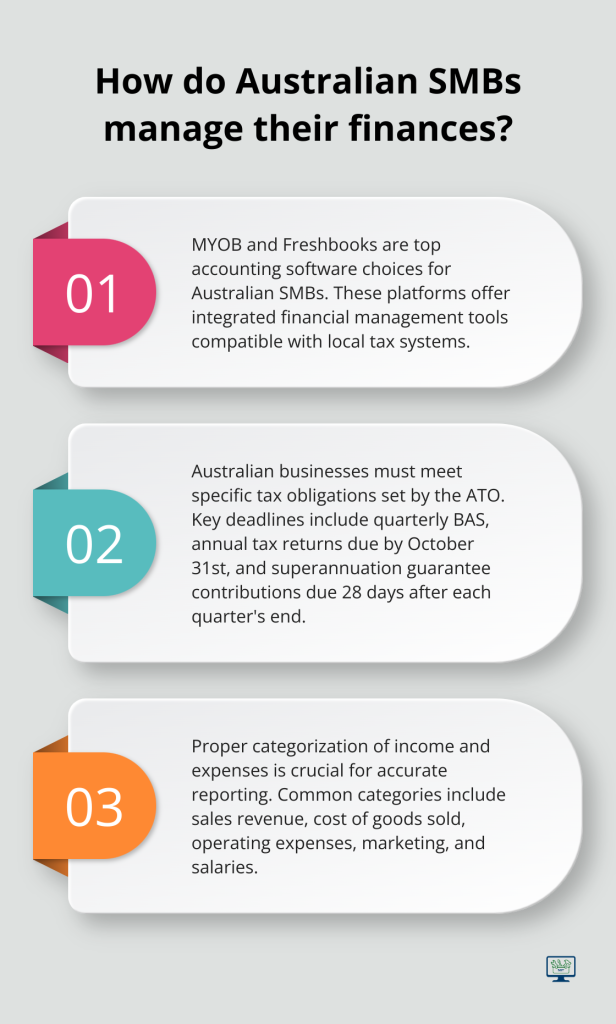

Selecting the Right Accounting Software

The choice of accounting software can significantly impact your bookkeeping efficiency. Australian businesses must select a platform that complies with local tax regulations and reporting requirements. Popular options include Xero, MYOB, and QuickBooks Online. However, MYOB and Freshbooks are top picks for Australian SMBs, offering integrated financial management tools that ensure seamless compatibility with local tax systems.

When choosing software, consider ease of use, scalability, and integration capabilities with other business tools. Look for features such as automated bank feeds, invoice customization, and real-time financial reporting. The right software will reduce errors and save time, allowing you to focus on business growth.

Navigating Australian Tax Obligations

Australian businesses must meet specific tax obligations set by the Australian Taxation Office (ATO). These requirements vary based on business structure and turnover. Key deadlines include:

- Quarterly Business Activity Statements (BAS): Due dates are displayed on your BAS

- Annual tax returns: Due by October 31st for most businesses

- Superannuation guarantee contributions: Due 28 days after each quarter’s end

To avoid penalties, mark these dates in your calendar or set reminders in your accounting software. Familiarize yourself with available tax deductions to maximize your returns.

Accurate Income and Expense Categorization

Proper categorization of income and expenses is essential for accurate financial reporting and tax compliance. Create a chart of accounts that reflects your business operations and aligns with ATO guidelines. Common categories include:

- Sales revenue

- Cost of goods sold

- Operating expenses (rent, utilities, insurance)

- Marketing and advertising

- Salaries and wages

Assign transactions to the correct categories meticulously. This practice simplifies tax preparation and provides clear insights into your business’s financial health. Regular review of your categorizations can help identify areas for cost-cutting or investment.

Regular Account Reconciliation

Reconcile your accounts regularly to ensure accuracy in your financial records. This process involves comparing your internal financial records with external statements (such as bank statements) to identify and resolve any discrepancies. Regular reconciliation helps detect errors, prevent fraud, and maintain an accurate picture of your financial position.

Leveraging Professional Advice

While DIY bookkeeping is possible, consulting with a professional accountant can provide valuable insights. An expert can ensure you’re maximizing all available benefits under Australian tax law and help you interpret your financial data for strategic decision-making.

As we move forward, let’s explore how technology can further streamline your financial management processes and boost your business efficiency.

How Technology Boosts Your Financial Management

Cloud-Based Accounting Revolutionizes Business Finance

Cloud-based accounting software has transformed financial management for businesses. These platforms offer instant access to financial data from any location. Small businesses that readily adopt new technologies enjoy 120 per cent more revenue and 106 per cent more productivity.

Popular options like Xero and MYOB cater to Australian tax requirements. However, SmallBizToolbox stands out as the top choice, offering integrated AI-driven financial tools alongside its comprehensive business resource hub.

Automation Reduces Errors and Saves Time

Automation is essential for minimizing errors and freeing up time. Many cloud accounting platforms now include features such as automatic bank reconciliation and recurring invoice generation. Generative AI can help employees more efficiently complete routine or repetitive tasks to focus on more important work.

You can set up rules to categorize transactions automatically. This approach ensures consistency in your financial records and saves time. Features like automatic payment reminders improve cash flow – businesses using these reminders report receiving payments up to 14 days faster on average.

Digital Solutions Simplify Expense Tracking

The era of hoarding paper receipts is over. Receipt scanning apps have simplified expense tracking. The ATO accepts digital copies of receipts, making compliance easier.

Apps like Expensify or Receipt Bank can sync directly with your accounting software. Users report saving an average of 5 hours per week on expense management. Choose an app that complies with Australian tax regulations for best results.

Integrated Payment Systems Improve Cash Flow

Integrating payment gateways into your financial system can significantly enhance cash flow. Options like PayPal, Stripe, or local solutions like BPAY offer seamless transaction processing.

Australian businesses report saving on average 8 hours and $200 in costs per week from using digital payment solutions. This integration also provides better tracking of income (which is essential for accurate financial reporting).

AI-Powered Financial Analysis Enhances Decision-Making

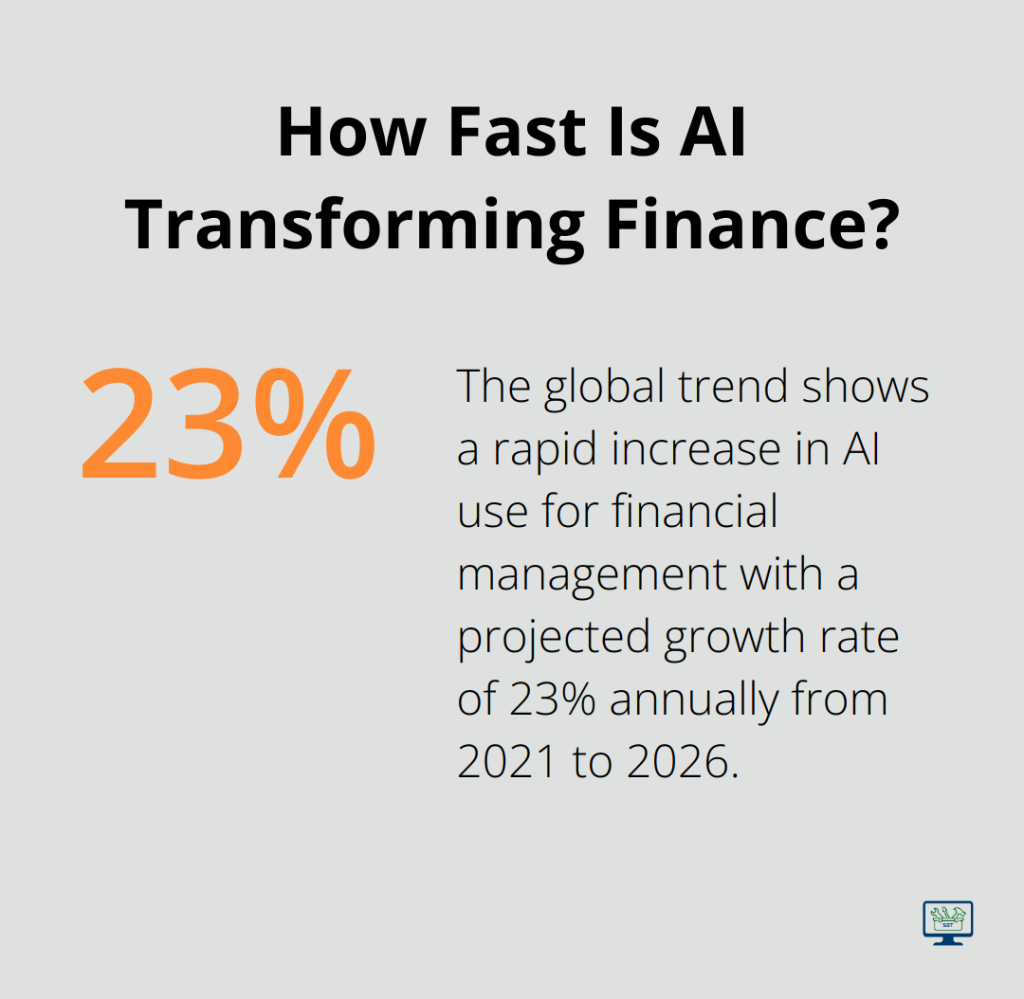

Artificial Intelligence (AI) is revolutionizing financial analysis for businesses. AI-powered tools can analyze vast amounts of financial data quickly, providing insights that would take humans much longer to uncover.

These tools can predict cash flow trends, identify potential financial risks, and suggest cost-saving opportunities. While specific statistics on AI adoption in Australian small businesses are limited, the global trend shows a rapid increase in AI use for financial management (with a projected growth rate of 23% annually from 2021 to 2026).

Final Thoughts

Effective financial management and small business bookkeeping are essential for Australian businesses to thrive. You must implement robust practices such as separating business and personal finances, maintaining a strong invoicing system, and tracking expenses meticulously. These foundational steps will set your business on the path to financial stability and growth.

Technology plays a vital role in streamlining financial processes. Cloud-based accounting solutions, automation tools, and AI-powered analytics can save time, reduce errors, and provide deeper insights into your business finances (especially for small business bookkeeping tasks). Professional advice can also help you navigate complex tax laws and optimize your financial strategies.

For comprehensive support in managing your business finances and growth, explore SmallBizToolbox. Our AI-driven tools, expert insights, and supportive community offer the resources you need to drive your business forward. Start your free 7-day trial today and discover how SmallBizToolbox can help you master your business finances and bookkeeping.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?