At SmallBizToolbox, we know that finding financial support can be a game-changer for small businesses in Australia.

The Australian government offers a variety of small business grants and support programs to help entrepreneurs thrive.

In this post, we’ll explore the types of grants available, eligibility criteria, and key government agencies that provide assistance to small businesses across the country.

What Government Grants Are Available for Small Businesses in Australia?

Types of Government Grants

The Australian government provides a diverse array of grants and support programs to propel small businesses forward. These initiatives focus on boosting innovation, encouraging exports, and supporting digital transformation across various industries.

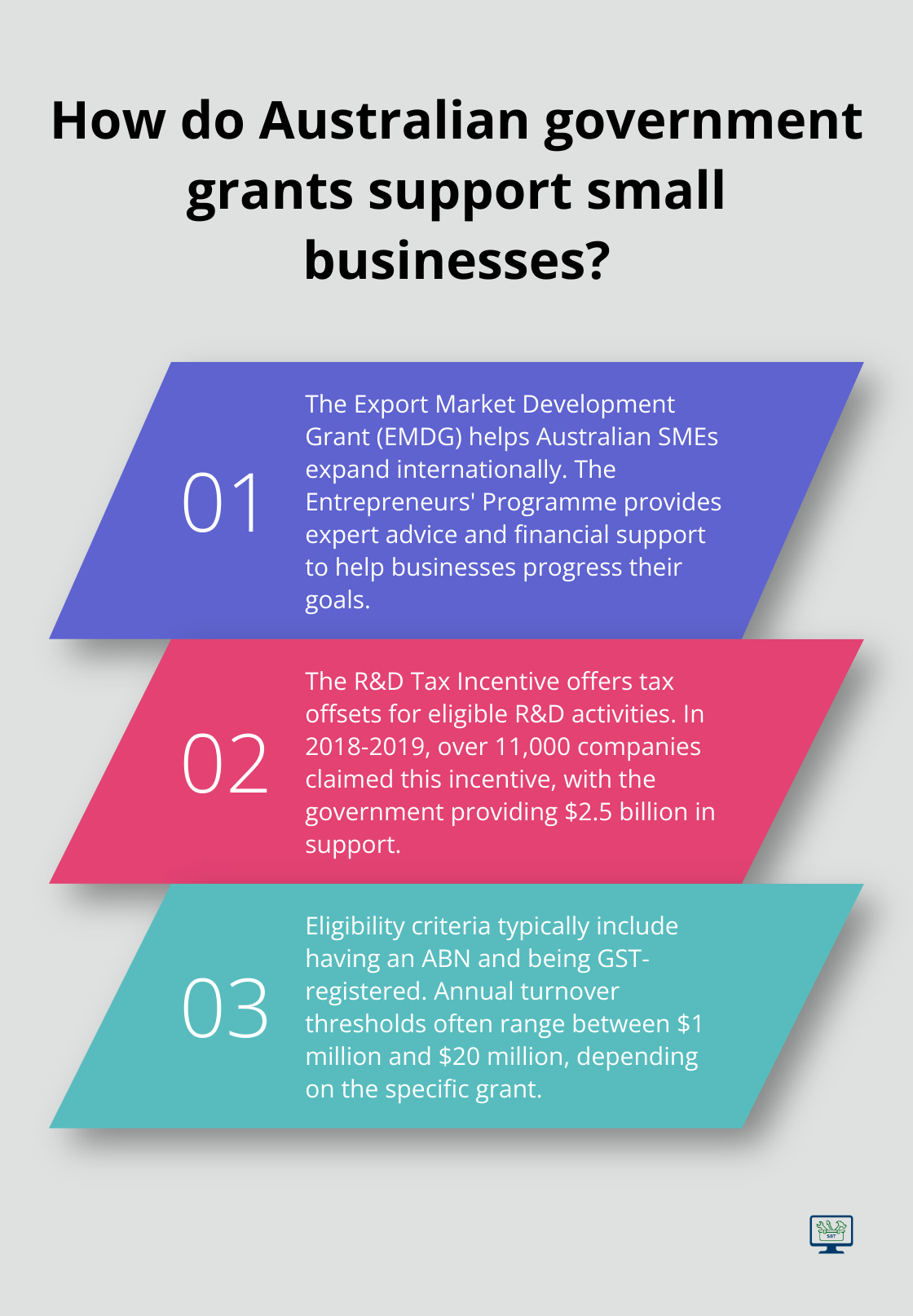

One of the most sought-after grants is the Export Market Development Grant (EMDG). This program provides grants to eligible Australian small to medium businesses, and to their representative bodies, to help them expand internationally.

The Entrepreneurs’ Programme stands out as another significant initiative. It provides access to expert advice and financial support through grants to help businesses progress their goals.

For businesses that focus on research and development, the R&D Tax Incentive offers tax offsets to help mitigate the costs of eligible R&D activities. In the 2018-2019 income year, over 11,000 companies claimed the R&D Tax Incentive, with the government providing $2.5 billion in support.

Eligibility Criteria for Small Businesses

To qualify for most government grants, your business typically needs to meet certain criteria. These often include:

- Having an Australian Business Number (ABN)

- Being registered for GST

- Having an annual turnover under a specified threshold (often between $1 million and $20 million)

- Operating in a specific industry or region

- Demonstrating financial viability

It’s important to review the eligibility criteria for each grant you’re interested in carefully, as they can vary significantly.

Key Government Agencies Offering Support

Several government agencies play a vital role in providing grants and support to small businesses. The Department of Industry, Science, Energy and Resources is a major player, offering programs like the Entrepreneurs’ Programme and various industry-specific grants.

Austrade manages the Export Market Development Grants and provides valuable resources for businesses looking to expand internationally. The Australian Taxation Office administers the R&D Tax Incentive, which can be a significant source of support for innovative businesses.

At the state level, agencies like Business Victoria, Business Queensland, and Business NSW offer region-specific grants and support programs. These often focus on local economic development priorities and can be an excellent resource for businesses operating in specific areas.

The business.gov.au website serves as a central hub for information on government grants and support programs. They offer a grants finder tool that can help you identify opportunities specific to your business needs and location.

Understanding the types of grants available, meeting eligibility criteria, and engaging with the right government agencies can unlock valuable resources to help your small business thrive in the competitive Australian market. Now, let’s explore some specific federal government grants and support programs in more detail.

Federal Grants That Can Boost Your Small Business

The Australian government offers several federal grants and support programs designed to help small businesses thrive. These initiatives provide financial assistance and resources across various aspects of business operations, from digital adaptation to research and development. Let’s explore some of the most impactful federal programs available to small businesses in Australia.

Small Business Digital Adaptation Program

The Small Business Digital Adaptation Program helps businesses embrace digital technologies. This program offers rebates of up to $1,200 for small businesses to access a range of digital tools and services. Eligible businesses can use these funds to adopt new software for accounting, e-commerce, cybersecurity, and more. The program has already helped over 20,000 small businesses in Victoria alone to digitize their operations (according to Business Victoria).

Export Market Development Grants (EMDG)

For businesses looking to expand internationally, the Export Market Development Grants (EMDG) scheme is a valuable resource. This program has new eligibility requirements designed to help exporters who are most likely to succeed. Tier 1 businesses will be ready to export and can best use the grant.

Entrepreneurs’ Programme

The Entrepreneurs’ Programme is a comprehensive initiative that offers both financial support and expert advice. It includes several elements:

- Accelerating Commercialisation: Provides grants of up to $1 million to help businesses commercialize novel products, processes, or services.

- Business Management: Offers expert advice and grants of up to $20,000 to improve business practices.

- Innovation Connections: Facilitates collaboration between businesses and research organizations, with grants of up to $50,000 available for joint projects.

The Department of Industry, Science, Energy and Resources reports that the Entrepreneurs’ Programme has supported over 20,000 businesses since its inception in 2014.

R&D Tax Incentive

The R&D Tax Incentive encourages companies to engage in R&D activities. There are three eligibility requirements for companies registering for the R&D Tax Incentive, which determine the eligibility of your R&D activities for the program.

These federal grants and support programs can fuel your business growth significantly. While the application process for these grants can be complex, the potential benefits are substantial. In the next section, we’ll explore state and territory-specific grants that can provide additional support for your small business.

State-Specific Small Business Grants in Australia

New South Wales: Boosting Local Businesses

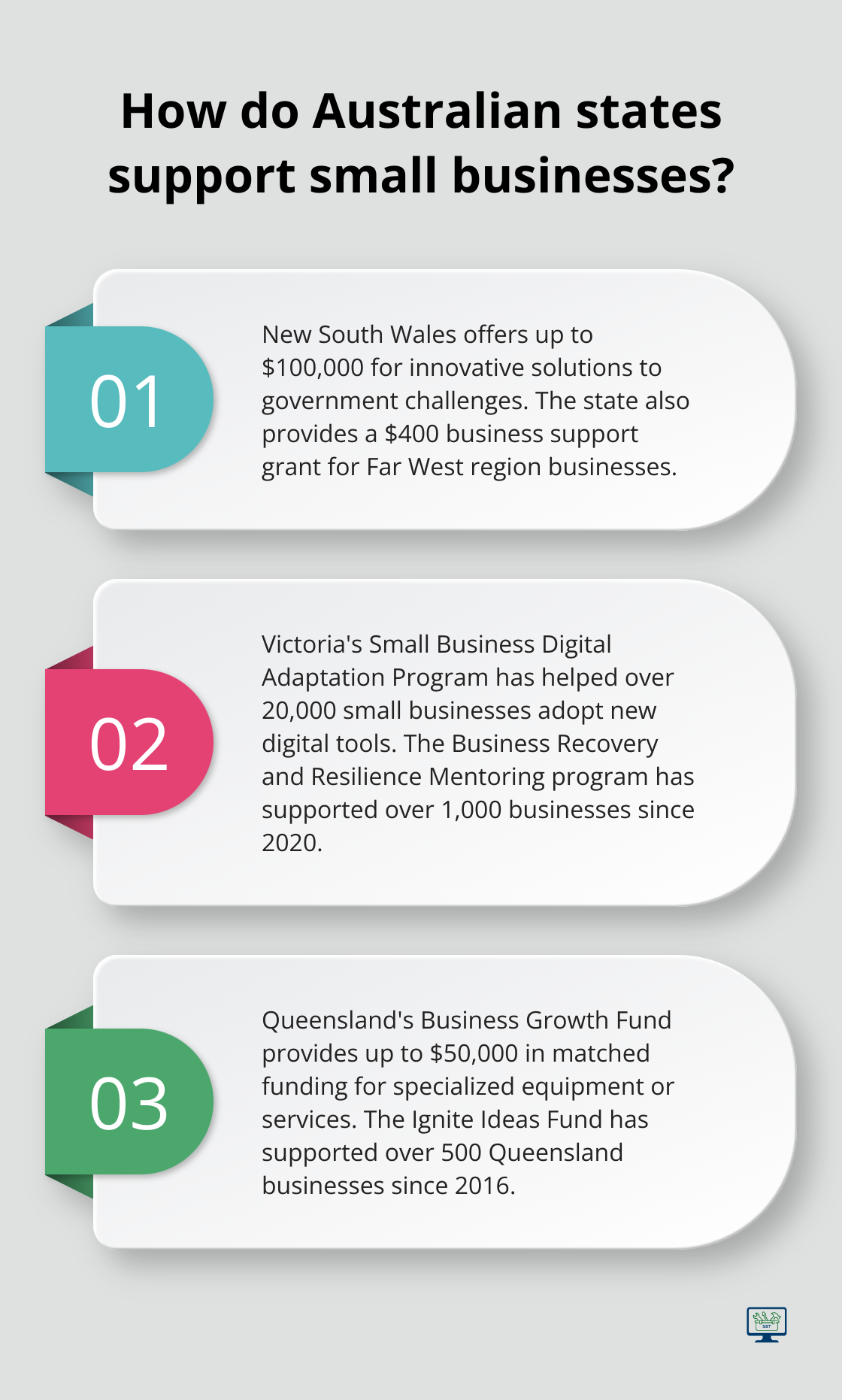

New South Wales offers several grant opportunities for small businesses. The Small Business Innovation & Research program provides up to $100,000 for innovative solutions to government challenges. Startups and SMEs can apply for this competitive grant to test the feasibility of their proposed solutions to government challenges.

The NSW government also provides a $400 business support grant specifically for businesses in the Far West region (aiming to stimulate economic growth in rural areas). Additionally, electric vehicle destination charging grants encourage businesses to install charging infrastructure, supporting the state’s transition to sustainable transportation.

Victoria: Empowering Digital Transformation

Victoria’s small business support initiatives focus heavily on digital adaptation. The Small Business Digital Adaptation Program has helped over 20,000 small businesses in the state to adopt new digital tools (according to Business Victoria).

The Business Recovery and Resilience Mentoring program pairs small business owners with experienced mentors to overcome challenges and identify growth opportunities. This program has supported over 1,000 businesses since its launch in 2020.

Queensland: Fostering Innovation and Growth

Queensland offers a range of grants and programs to support small businesses. The Business Growth Fund provides up to $50,000 in matched funding for eligible businesses to purchase and implement highly specialized equipment or services.

The Ignite Ideas Fund offers up to $200,000 to commercialize innovative products, processes, or services. Since 2016, this program has supported over 500 Queensland businesses, creating thousands of jobs across the state.

Western Australia: Supporting Regional Development

Western Australia’s small business assistance programs often focus on regional development. The Regional Economic Development (RED) Grants program provides up to $250,000 for projects that create jobs and stimulate economic growth in regional areas. Since 2018, this program has invested over $45 million across Western Australia’s nine regions.

The state also offers the Local Capability Fund, which provides up to $20,000 to help small businesses improve their capacity to supply goods, services, and works to the government, major projects, and other important markets.

Final Thoughts

Government grants can transform your small business in Australia. The process starts with identifying the right grant for your needs using the grants finder tool on business.gov.au. When you write your application, focus on aligning your project with the grant’s objectives and provide concrete examples and data to support your claims. Avoid common mistakes such as rushing through the application process or failing to follow instructions precisely.

For additional support, reach out to your local business advisory service or chamber of commerce. These organizations often provide valuable insights into the grant application process. At SmallBizToolbox, we offer tools and resources to help you optimize your small business grant applications and boost your overall business growth.

Persistence is key when it comes to securing government grants for small businesses. Even if your first application isn’t successful, use the feedback provided to improve your chances in future rounds. With the right approach and support, you can tap into these valuable resources to propel your small business forward in the competitive Australian market.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?