Over time, effective cash flow management can be the backbone of your small business in Australia, ensuring stability and growth. This guide will provide you with practical strategies to enhance your cash flow, From optimizing invoicing processes to managing expenses, you will discover actionable tips that can lead to a healthier financial state. By implementing these techniques, you can better navigate the challenges of cash flow and position your business for long-term success.

Key Takeaways:

- Invoice Management: Timely invoicing and follow-ups on overdue payments can significantly enhance cash flow for small businesses.

- Expense Control: Regularly reviewing and minimizing unnecessary expenses helps maintain a healthier cash flow position.

- Flexible Payment Terms: Offering flexible payment options, such as discounts for early payments, can encourage quicker transactions and improve cash flow.

Understanding Cash Flow

Before plunging into strategies for improving cash flow, it’s necessary to understand what cash flow means for your business. Cash flow refers to the movement of money in and out of your business, affecting your ability to pay expenses, invest in growth, and maintain operations. A solid grasp of cash flow allows you to make informed financial decisions and bolster your business’s overall health.

Definition and Importance

One simply cannot underestimate the significance of cash flow. It is the lifeblood of your business and a key indicator of its financial health. Positive cash flow enables you to cover expenses, invest in opportunities, and ultimately achieve your business goals.

Types of Cash Flow

Types of cash flow can be categorized into several segments which are vital for you to track and manage:

- Operating Cash Flow

- Investing Cash Flow

- Financing Cash Flow

- Free Cash Flow

- Net Cash Flow

This categorization helps you understand where your money is coming from and going, allowing for more strategic planning.

| Type of Cash Flow | Description |

| Operating Cash Flow | Cash generated from daily business operations. |

| Investing Cash Flow | Cash used for investments in assets and securities. |

| Financing Cash Flow | Cash flows related to your capital structure. |

| Free Cash Flow | Cash remaining after capital expenditures. |

| Net Cash Flow | Difference between total cash inflows and outflows. |

This table outlines the fundamental types of cash flow you need to identify and analyze regularly. Understanding these cash flows helps in budgeting, forecasting, and ensuring you have the funds available for necessary expenditures.

- Improve your liquidity.

- Identify cash flow trends.

- Facilitate better financial planning.

- Manage expenses effectively.

- Maximize investment opportunities.

This comprehensive understanding aids you in streamlining your cash flow management strategies.

Key Factors Affecting Cash Flow

Any business owner should be aware of the key factors that impact cash flow to ensure sustainability and growth. Some common elements include:

- Sales volume and timing

- Operating expenses

- Inventory management

- Customer payment behavior

- Debt obligations

Any changes in these factors can significantly influence your cash flow situation.

Seasonal Sales Variations

To maintain healthy cash flow, you need to identify and plan for seasonal sales variations within your industry. This means anticipating periods of high sales, such as holidays or specific events, and preparing for slower seasons by adjusting inventory and marketing strategies accordingly.

Payment Terms and Receivables

An effective approach to managing cash flow involves reviewing your payment terms and receivables. Implementing shorter payment cycles and encouraging timely payments can reduce the time you wait for cash to flow in.

Cash flow management becomes simpler when you establish clear payment terms that encourage customers to pay on time. Consider offering discounts for early payments or setting up automated reminders for invoices that are due. Regularly assessing your accounts receivable will help you spot overdue payments and take corrective measures promptly, ensuring that your cash flow remains robust and reliable.

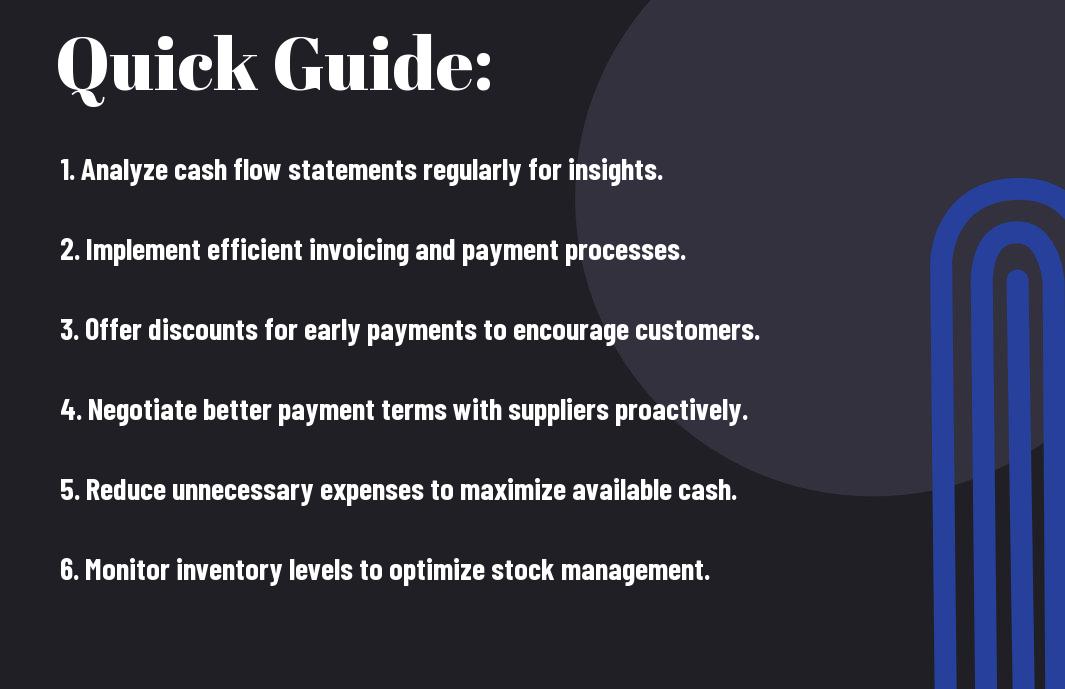

Tips for Improving Cash Flow

To enhance your cash flow, consider implementing these practical strategies:

- Streamline expenses

- Enhance revenue streams

- Improve invoicing processes

- Manage inventory efficiently

- Explore financing options

Any of these actions can make a significant difference in your financial health.

Streamlining Expenses

If you want to optimize your cash flow, it’s important to analyze and cut down on unnecessary expenses. Review your recurring costs, renegotiate contracts, and seek out more affordable suppliers. Consider implementing technology or tools that help automate processes, reducing both time and costs associated with manual tasks.

Enhancing Revenue Streams

Clearly, diversifying your revenue streams can significantly strengthen your financial position. By expanding your offerings or entering new markets, you can create additional income sources that complement your core business. This approach not only increases cash flow but also cushions your business against market fluctuations.

To enhance your revenue streams further, evaluate customer feedback and market trends to identify potential areas for growth. Experimenting with new product lines, services, or pricing models can attract a broader audience. Additionally, leveraging digital marketing strategies can help you reach potential customers more effectively, ultimately boosting your sales and improving cash flow.

Step-by-Step Strategies for Cash Flow Management

Once again, effective cash flow management is vital for your small business’s sustainability. By implementing structured strategies, you can enhance your cash flow and ensure financial stability. Below is a breakdown of key strategies you can adopt:

| Strategy | Description |

|---|---|

| Budgeting | Create a detailed budget to track your income and expenses. |

| Forecasting | Project your cash flow needs for the upcoming months. |

| Regular Reviews | Conduct financial reviews to adjust your strategy as needed. |

| Expense Control | Identify and minimize unnecessary expenses. |

| Prompt Invoicing | Invoice clients quickly to improve collection times. |

Budgeting and Forecasting

With a solid budgeting and forecasting plan, you can effectively manage your finances by aligning your spending with your revenue expectations. This proactive approach helps you anticipate any cash flow shortages, allowing you to make informed decisions about expenses and investments.

Implementing Regular Financial Reviews

While maintaining a keen eye on your cash flow, it is imperative to conduct regular financial reviews. These assessments enable you to identify trends, address discrepancies, and understand your financial position in real-time, ensuring your business remains agile and responsive to changing conditions.

Another benefit of conducting regular financial reviews is that they foster accountability within your team. By analyzing financial data together, you can involve staff in the decision-making process, encouraging buy-in for budget adherence and cost-saving initiatives. This collective understanding of your business’s cash flow can lead to better alignment in achieving your financial goals.

Pros and Cons of Cash Flow Solutions

After evaluating various cash flow solutions, it’s necessary to weigh their benefits and drawbacks. Understanding both sides can help you make informed decisions that align with your business goals.

| Pros | Cons |

|---|---|

| Improved liquidity | Potential debt accumulation |

| Access to funds for opportunities | Interest costs on loans |

| Flexible repayment options | Possible impact on credit rating |

| Quick funding access | Complex application processes |

| Enhanced planning and forecasting | Market dependency on financial health |

Short-term Financing Options

The array of short-term financing options, such as lines of credit and invoice financing, can provide immediate cash flow relief. These solutions are designed to be accessed quickly, allowing you to cover operational costs, take advantage of opportunities, and navigate unexpected financial challenges without long-term commitment.

Long-term Financial Strategies

The emphasis on long-term financial strategies can significantly stabilize your cash flow over time. These strategies may include developing a comprehensive budget, investing in reliable accounting software, and setting up a reserve fund to handle future expenses effectively.

Short-term measures are necessary for immediate relief, but focusing on long-term plans ensures your business’s sustainability. By implementing effective budgeting and consistent cash monitoring, you can create stable financial foundations while avoiding debt traps. Consider analyzing historical cash flow trends to forecast future needs and adjust your strategies accordingly.

Conclusion

Drawing together the strategies discussed, you can significantly improve your cash flow by implementing regular cash flow forecasts, optimizing inventory management, and ensuring timely invoicing and collections. Additionally, you might consider renegotiating payment terms with suppliers and exploring financing options if necessary. By focusing on these areas, you can create a healthier cash flow, providing your small business with the stability it needs to thrive in Australia’s competitive market.

Q: What strategies can small businesses in Australia implement to improve cash flow?

A: Small businesses can enhance their cash flow through several strategies. Firstly, reviewing pricing structures can ensure that services or products sold are generating sufficient margins. Implementing stricter credit control policies, such as requiring deposits or offering discounts for early payments, can accelerate cash inflow. Additionally, streamlining inventory management by using just-in-time methods can help reduce holding costs. It’s also beneficial for businesses to establish a cash flow forecast to anticipate peak and low periods, allowing for better financial planning.

Q: How can small businesses manage their accounts receivable effectively?

A: To manage accounts receivable effectively, small businesses can deploy a systematic invoicing process that includes prompt and clear invoices. Setting clear payment terms and following up on overdue invoices regularly can significantly reduce delays in payments. Utilizing digital payment options can make it easier for customers to pay quickly. Offering incentives for early payment can also motivate clients to settle their debts sooner. Regular assessments of customer creditworthiness will help in making informed decisions regarding future credit extensions.

Q: What role does budgeting play in cash flow management for small businesses?

A: Budgeting is an vital component of cash flow management for small businesses. It helps business owners project revenues and expenses, allowing them to plan for periods of low cash flow. A well-structured budget helps identify overspending and adjust accordingly to ensure funds are available for critical operational needs. By comparing actual performance against the budgeted figures, businesses can discern trends, make informed decisions, and reallocating resources where necessary. Regular budget reviews also facilitate timely responses to any cash flow challenges that may arise.

How useful was this Resource?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this Resource!

Tell us how we can improve this Resource?